2025 Top 100 Rated Charities

Charity Intelligence 2025 Top 100 Rated Charities

Charities are listed alphabetically by sector. Click on the charity's name to read Charity Intelligence's full report.

The list is also available in pdf format.

The 2025 giving season begins. Giving money away is easy, but giving done well takes effort. For the many generous donors who don’t have the time for research and due diligence, Charity Intelligence’s 2025 Top 100 list highlights those charities that rate the highest relative to their peers.

Be curious! Check out the charities on the 2025 Top 100 list. The Top 100 list is a handy tool for your giving. Indeed, 20% of you use Charity Intelligence’s Top Charities list and give to charities you had never given to before. The 2025 Top 100 list covers all the sectors from animal charities to United Ways, health, education and environmental charities. The internationals are always the most popular.

Charity Intelligence’s research reports on Canadian charities help you be informed and give intelligently. 89% of donors say that Charity Intelligence’s reports make them feel better informed about their giving. And with these facts and figures, you feel more confident in your giving. Our survey says that, with greater confidence, you give 21% more money.

Each year since 2014 Charity Intelligence has released a Top 100 list of charities based on our ongoing research and analysis of Canadian charities. Each year only 100 charities earn the highest 5-star rating. Charity Intelligence’s ratings strive to strengthen philanthropy by rewarding charities that have world-class disclosure about results reporting and spending.

Key highlights from 2025’s research

Small improvements across the board. Today, Canadian charities are more financially transparent and accountable than ever before. The annual progress is incremental but meaningful in such a huge sector that receives an estimated $22 billion in donations.

20 charities are new to the 2025 Top 100 list. Congratulations to these new charities and to all those that have worked hard to improve their disclosure about their results, activities and spending.

In 2025, Charity Intelligence updated 418 charity reports so you have the most recent and relevant data to make your giving decisions. Our research analysts use a charity’s audited financial statements. This gives you higher data quality and information faster than it is released in the CRA Charities Directorate’s database.

Charity Intelligence is independent and objective. Our research is funded by donors, for donors. Charities do not pay for this analysis. If you appreciate Charity Intelligence’s work, please consider a donation to Charity Intelligence.

What makes a 5-star charity?

Each day, Charity Intelligence receives emails from charities across Canada asking about being rated and what it takes to be a 5-star Top 100 charity. Charity Intelligence uses standardized metrics.

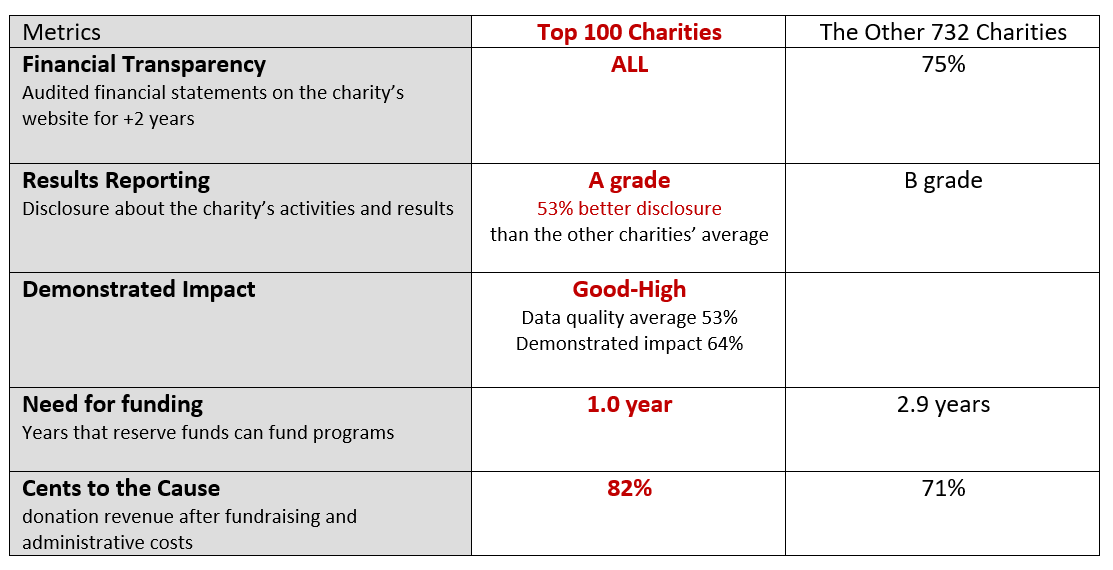

Financial transparency

Charities are public organizations registered to provide a public benefit. Best practice is to have audited financial statements posted on the charity’s website. Pie charts in annual reports don’t get points for financial transparency. Canadian donors expect charities to be financially transparent. Most charities (78%) meet donors’ expectations.

Results reporting

Charities should not just be judged solely on financial metrics but by their social results. Charity Intelligence uses the Keystone Six questions to evaluate a charity’s disclosure about its results for the year. Most Canadian charities lag behind international standards in results reporting, especially compared to the disclosure of British and Australian charities. The Top 100 charities report their results at world class levels and average an A grade, with disclosure 53% higher than the rest of the charities.

Need for funding

Donors are well familiar with charity overhead ratios, how much is spent on fundraising and administration. In contrast, a charity’s need for funding is rarely assessed. Some charities fundraise because they can rather than because they have a need for donations. Donors need to evaluate a charity’s financial need for donations. The Top 100 charities have a financial cushion of 1 year compared to the rest of the charities that have reserve funds that cover program spending for 2.9 years. In the extreme, 125 Canadian charities have reserve funds that amply cover five years or more of program spending. The reserve funds of these 125 “rich charities” total $14.6 billion.

Cents to the cause

The Top 100 charities are more cost efficient. The Top 100 charities have overhead spending that averaged 18%, with 82 cents going to the cause. The rest of the charities have overhead spending of 29%. For most charities, overhead spending is in a reasonable range. One disturbing trend is the growing number of charities that are “offside” with high fundraising costs. The CRA’s guidance is that charities should not spend more than 35% of fundraising revenues on fundraising costs. In 2025’s research, 82 charities spent over the 35% fundraising limit. The rampant spending on fundraising by a few charities puts pressure on other charities to keep up or lose out as “everyone else is doing it”. This can create a spiral trend of higher overhead costs, reduced productivity, and dilution for donors. Donors have an important role to play in arresting this negative cycle.

Demonstrated impact

Measuring a charity’s impact is complex, especially given scarce program data and the results charities report. Impact looks at how well a charity’s programs change lives, its effectiveness (not cost efficiency). It measures the value the charity’s programs create. For example, a charity could be “cheap” with low overhead spending, but its programs might not create change (ineffective). There are many do gooders. Impact looks for the good doers. For the Top 100, where Charity Intelligence has measured the demonstrated impact, the impact must be at least average. Average is an SROI of approximately 1.5 to 1. For charities where Charity Intelligence has not measured impact, this shows as n/r (not rated) and it does not affect the charity’s star rating.

What makes a 5-star charity in 2025?

Last word

To get a higher star rating from Charity Intelligence, Toronto Foundation for Student Success said it improved its program evaluation. Since then, it began to review the program data. The data helped TFSS improve the services it offers to the children and families it serves. Data is dry and dull, but we see data's great potential to help charities and donors improve.

Charity Intelligence’s work strives to strengthen giving by providing independent and objective research donors can use to give intelligently and so their giving can make the biggest difference.

If you find Charity Intelligence’s research useful in your giving, please consider donating to support our work. Being entirely funded by donors like you maintains our independence and objectivity to help Canadians be informed in their giving. Canadians donate over $22 billion each year. This giving could achieve tremendous results. We hope Charity Intelligence's research helps Canadians give better.

References:

Angus Reid survey "Philanthropy, Pandemic & Political Scandal: Covid-19 curtails donor giving (estimate from survey responses), WE affair weakens trust in charities, September 17, 2020.

Legal disclaimer:

The information in this report was prepared by Charity Intelligence Canada and its independent analysts from publicly-available information. Charity Intelligence and its analysts have made endeavours to ensure that the data in this report is accurate and complete but accept no liability.

The views and opinions expressed are to inform donors in matters of public interest. Views and opinions are not intended to malign any religion, ethnic group, organization, individual or anyone or anything. Any dispute arising from your use of this website or viewing the material hereon shall be governed by the laws of the Province of Ontario, without regard to any conflict of law provisions.

Charity Intelligence's 2024 Sector Snapshot

Click here to view the article in pdf format.

While Charity Intelligence’s research on 829 charities represents just 1% of all registered charities, it accounts for nearly 50% of all donations, offering a meaningful glimpse into sector-wide trends. Though not exhaustive, this data sheds light on how the sector – and its largest players – have evolved over time. Our 2024 Sector Snapshot analyzes the latest available fiscal data from the 829 charities on our website, with the most recent year typically being 2023.

2023 Highlights

- Donations to the 829 charities that Ci covers rose 7% to $12.2 billion.

- Financial transparency improved by 5%. In 2023, 34 charities opened their books and posted their audited financial statements on their website. 82% of charities Ci reviews (681 charities) are financially transparent in 2023 compared to 78% in 2022 (647 charities). Canadians universally expect charities to be financially transparent.

- Admin and fundraising costs grew to $4.8 billion, a 2% increase. Overhead averages 27% of donations and fundraising revenues compared to 26% in 2022. Most charities are in what Charity Intelligence calls a “reasonable range” for overhead, yet in 2023, 24 more spend above this range.

- Reserve funds remain lower than pandemic levels but are beginning to increase. The relative wealth of the “richest” charities rose by 5% in 2023, with their reserve funds reaching $9.6 billion. Donors need to discern between which charities need donations, and which charities already have enough.

- Charity reporting improved by 3% – the scores for how well charities report their results. This increased from an average score of 108 to 111.

Donations Rose by 7% in 2023

Ci’s 2023 data shows donations[1] reached a record $12.2 billion – a 7% increase from $11.4 billion in 2022. The growth significantly outpaced inflation, which was 4% in 2023. This increase in donations runs counter to the common narrative that giving is declining as our data accounts for giving beyond the tax-receipted donations reported on tax forms / a charities annual filings to the CRA Charities Directorate. Canadians are generous and giving is at record levels in 2023.

Financial Transparency Improved by 5%

Financial transparency measures whether a charity publicly shares its audited financial statements. Audited financial statements are the only reliable way to see how a charity spends its money. The CRA recommends that charities with over $250k in annual revenue maintain financial transparency. Of the 829 charities on Ci’s website, 681 (82%) are financially transparent, up from 647 (78%) in 2022 – a 5% increase. While this is an improvement, the 18% that are not transparent received $1.7 billion in donations in 2023. This represents $1.7 billion given blindly.

A Quarter of Charities Spend Excessively on Overhead in 2023

In 2023, total spending on overhead, which includes fundraising and administrative costs, rose by 2% to $4.8 billion. The average charity spent 27%[2] of its donations and revenue on overhead. This is a slight increase compared to 26% in 2022. Ci’s reasonable range for overhead spending is between 5% and 35% of donations and revenue[3]. Most charities have reasonable overhead spending.

However, Canadians need to pay attention to overhead spending with those charities that spend too much. In 2023, 210 charities (25%) spent more on overhead than the 35% reasonable limit. This is an increase from 186 charities (22%) in 2022.

For those charities that exceed the reasonable range of 35%, the average spending on overhead was 53%. This excess is offside on CRA Charities Directorate’s guidance that a charity must spend the majority of its resources on programs and not fundraising. The average charity within Ci’s range spends just 20%.

7 More Cents on Every Dollar Raised Goes Toward Programs

Despite this increase in overhead, charities demonstrated improved efficiency in program spending. In 2023, charities spent $39.1 billion on programs[4] – an 8% increase from $36.1 billion in 2022. Program spending represented 75% of total revenue[5], up from 68% in 2021. For every dollar charities raised, they spent 7% more on their programs in 2023, versus during the pandemic (2021).

“Profit Margin” Squeeze in 2023

Thinking about profit margins at charities might seem counterintuitive – after all, they are non-profits. But charities don’t call it “profit”; they call it “surplus” or “deficit.” In 2023, the sector reported a $4.2 billion surplus (8% of revenue), down from $7.5 billion (15% of revenue) in 2021. Most charities run a modest surplus, but some rake it in.

Net Reserves Down from 2021, but the “Rich” Continue to Deepen Pockets

In addition to looking at charities’ revenues and spending, donors need to focus on a charity’s balance sheet. To discern if a charity is “rich” with millions, or hundreds of millions in cash and investments, as compared to charities that need donations to do their work in the short term.

Net reserve funds[6] totalled $39.1 billion in 2023. This is an 8% increase compared to $36.3 billion in 2022. Despite this increase, reserve funds remain significantly lower than the $58.6 billion held in 2021, when charities retained more cash during the pandemic.

More important than the absolute dollar value of reserve funds is the reserve funds relative to a charity’s annual spending on programs[7]. A financial cushion where a charity has funds to run its programs for a year is healthy. Consider two charities, each with $10 million in cash and investments. One charity’s programs cost $10 million a year. The other charity spends $1 million a year. One charity has a healthy reserve of 1 year, while the other has 10 years of money on hand.

Of the charities we track, 120 (14%) have enough money to fund their programs for 5 or more years. We do not think this is typical. We believe some of the wealthiest charities in the world reside in Canada. Yet they continue to fundraise each year. Despite only making up 14% of all charities, the reserve funds held by these “rich charities” represent 24% of the total.

|

Years of Program Cost Coverage[7] |

Number of charities |

% of charities |

Value of Reserve Funds $ billion |

|

Under 1 year |

372 |

45% |

9.9 |

|

1 – 2 years |

196 |

24% |

13.0 |

|

2 – 3 years |

82 |

10% |

3.1 |

|

3 – 5 years |

59 |

7% |

3.6 |

|

Over 5 years |

120 |

14% |

9.6 |

In 2023, the 14% “wealthiest” charities increased their reserves by 5%, while program spending decreased by half a percentage point. For these “rich” charities, they have enough reserve funds to cover their program spending for 10 years in 2023. This abundance represents a 15% increase from 8.4 years in 2022.

Accountability to Donors Improved by 3%

Results Reporting grades are a proxy for accountability, assessing how effectively a charity communicates its performance and impact. Charity Intelligence evaluates reporting across six sections: strategy, activities, outputs, outcomes, quality, and learning. Stronger reporting enables donors to better understand a charity’s achievements and how their contributions make a difference. This helps donors make informed giving decisions.

In 2023, the average Results Reporting score increased by 3%[8], indicating an overall improvement in accountability. This improvement was equal across all six sections.

Results Reporting performance varies significantly across sectors. Universities, food banks, and animal welfare charities outperformed the average charity, reporting their results 33%, 23%, and 19% better, respectively. In contrast, religious charities, arts and culture organizations, and hospital foundations reported their results 40%, 26%, and 21%, worse than the average, respectively. The 3% improvement in Results Reporting scores in 2023 reflects progress in accountability. Yet the significant disparities across sectors highlight the need for consistent reporting to ensure donors can make well-informed giving decisions.

Closing Note

The charity sector in 2023 showed both progress and persistent challenges, as reflected in the data from Charity Intelligence’s analysis. Donations and total revenue experienced record growth, with program spending efficiency improving significantly since the pandemic. However, overhead costs rose. Giving remains concentrated with most donations going to few charities. This shows as a growing gap between a few, “rich” charities. Knowing which charities have a need for funding and do not have multiple years of money in reserves continues to highlight the value of “doing your research” before donating.

Accountability rose again, a long steady trend of improvements. Looking at accountability by sectors shows gaps. An estimated 40% of giving goes to religious charities where the large religious charities have the lowest disclosure scores. Similarly, 25% of giving goes to hospital foundation, which also reports poorly, on average. In contrast, universities receive significant donations (25%) and rank top in disclosure.

The information on Charity Intelligence’s research is publicly available with the goal of helping donors make informed decisions. If you want to donate but are unsure where to begin, Charity Intelligence publishes a Top 100 Canadian Charities List, which highlights charities that score exceptionally well across all our metrics.

Want to get in touch? Reach me at This email address is being protected from spambots. You need JavaScript enabled to view it.

If you find Charity Intelligence’s research useful in your giving, please donate to support our work. Being funded by donors like you maintains our independence to help Canadians be informed in their giving. Canadians donate over $18 billion each year. This giving could achieve tremendous results. We hope Charity Intelligence’s research helps Canadians give better.

Legal disclaimer: The information in this report was prepared by Charity Intelligence Canada and its independent analysts from publicly available information. Charity Intelligence and its analysts have made endeavours to ensure that the data in this report is accurate and complete but accepts no liability.

The views and opinions expressed are to inform donors on matters of public interest. Views and opinions are not intended to malign any religion, ethnic group, organization, individual, or anyone or anything. Any dispute arising from your use of this website or viewing this material shall be governed by the laws of the Province of Ontario, without regard to any conflict or law provision.

Footnotes

[1] Donations include individual donations, corporate grants, charity grants, and special events fundraising.

[2] Loeys Dietz’s debt financing insurance policies result in fundraising costs of 3,000%, which skews the average for all charities analysed. Ci removed this one outlier each year for a more accurate representation of the average.

[3] Charity Intelligence’s overhead spending metric divides fundraising costs by donations and administrative costs by total revenue. The term “donations and revenue” refers to fundraising costs divided by donations and administrative costs divided by total revenue, less investment income.

[4] Program costs include domestic program costs, international program costs, grants, and donor designated donations.

[5] This represents cash revenue, excluding donated goods. Donated goods are traditionally a flow-through in the audited financials, representing the same amount on revenue and expenses. Including donated goods skews the data for certain sectors that primarily receive donated goods, like food banks.

[6] Net reserve funds are a charity’s cash and investments, less donor-endowed funds and interest-bearing debt.

[7] Charity Intelligence’s “Program Cost Coverage” metric tracks a charity’s relative “wealth”, measuring how many years of program costs a charity’s net reserves can cover. Ci’s reasonable range recommends that reserves cover no more than three years of annual program costs. In 2023, 22% of charities were outside Ci’s reasonable range, which is consistent with previous years (22% 2022 and 21% 2021).

[8] Of the charities we rated in 2023, compared to the charities we rated in 2022.

Lessons from Ottawa’s CAEH24 Ending Homelessness Conference

Charity Intelligence reports on 94 charities that address homelessness. We mainly focus on the largest charities that are concentrated in Canada’s large urban centres. The 2024 National Conference on Ending Homelessness – Canada’s largest two-day conference with over 2,000 attendants – was an opportunity for politicians to outline their policy approaches. It feels like easy talk about one of Canada’s most critical issues. Will more funding and more affordable housing end homelessness? Evidence and results from Canada’s frontline 518 emergency shelters would benefit all funders and decision makers.

We learned a lot from smaller municipalities: Kevin Webb – a member of the Canadian Shelter and Transformation Network – moderated an insightful Q&A session filled with smaller shelter representatives from Timmins, Medicine Hat, and other smaller towns. Conflict management strategies were a major discussion point. Specifically, managing residents who verbally or physically harm staff or fellow residents. These charities in smaller communities often lack specialized care resources for those suffering from addiction and psychotic episodes. These shelters face tough choices: tolerate harmful behaviour at the expense of the community or kick out the resident with no outflow plan. Surely there is a better approach.

Shelter leaders had different approaches. Some removed common conflict sources like breakfast lines (conflict is more likely when hungry and impatient residents jockey for a spot closer to the morning coffee). By removing lines and bringing food directly to residents, it removed a direct source of conflict. Others transferred clients to larger, more specialized care centres in larger cities. And others designed damage-resistant infrastructure like reinforced walls and doors.

Not all conversations were on successes. We had a conversation with Jaime Rogers – manager of Medicine Hat’s Community Housing Society – and learned that 20% of people do not benefit from Housing First’s policy of unconditionally housing those in need as quickly as possible. This is surprising considering previous research which reported an 88% success rate. We learned that this remaining 20% require extraordinary and specialized care; housing is not enough. Many seemed hesitant to openly discuss this important insight, with much of the discussion instead focusing on the 80% success rate.

Another session, focused on youth homelessness, covered different outflow strategies – when people leave a shelter, what happens next? When done poorly, youths lose the connections, structure, and support needed to navigate their futures. One shelter – Guelph’s Wyndham House – dominated the discussion. It offers rent support and maintains contact with former shelter residents months after departure. When needed, it refers former clients to specialized support such as the Homewood Health Centre, a local addiction recovery centre.

This is only a small snapshot of all we learned. We look forward to learning more and sharing more insights on our work in future articles.

Questions? Want to get in touch? Reach me at This email address is being protected from spambots. You need JavaScript enabled to view it.

Want to learn more? See Charity Intelligence’s top 100 charities list here. You can read about Charity Intelligence's ranking methodology here.

Sources:

Shelter Capacity Report 2022, Statistics Canada, 2022

The Case for Housing First, National Low Income Housing Coalition, 2021

Top 10 Impact Charities

A growing niche of donors each year is looking for terrific charities to support, particularly those that have measurable, proven, and high impact.

Most charities claim that they “make a difference” in the lives of those they work with, but it is very difficult for donors to tell how much of a difference any given charity is making. Charity Intelligence’s rigorous analysis measures this difference, or the impact, charities actually make to see how each dollar we give can create the most positive change. It’s a different way to think about giving.

Over $19 billion was given to charities by Canadian donors last year and a significant portion of that is going to less effective charities. When a donor gives to a charity that creates very little change and they could have given to a charity that would have helped significantly more people, much of their donation is wasted. Canadians need better information to help them give better. Measuring a charity’s impact helps to reduce this waste.

“Some charities create a lot of change with the donations given to them. Others have almost nothing to show for the money coming from donors” says Greg Thomson, Director of Research at Charity Intelligence. “Of the 300 Canadian charities we have analysed for impact, these Top 10 have the highest measurable demonstrated impact.

This year’s overall Top 10 includes frontline charities providing education and addiction recovery in Canada as well as international programs bringing evidence-based programs to developing countries, like food and clean water, health, and education programs. Our calculations estimate this group of Top 10 Impact Charities delivers average returns of roughly 7 dollars for every dollar donated, compared with overall average charity returns of only about 1.5 dollars.

2025 Top 10 Impact Charities based on demonstrated impact per dollar donated (listed alphabetically):

| Charity | Location | Sector | To Donate |

| Against Malaria Foundation | Toronto, ON | International - Health | Donate |

| Canadian Foodgrains Bank | Winnipeg, MB | International - Food | Donate |

| The Citizens Foundation | Oakville, ON | International - Education | Donate |

| Daily Bread Food Bank | Toronto, ON | Food Bank | Donate |

| Doctors Without Borders | Toronto, ON | International - Health | Donate |

| Effect Hope | Markham, ON | International - Health | Donate |

| Food for Life | Burlington, ON | Food Bank | Donate |

| Fresh Start Recovery | Calgary, AB | Addiction Recovery | Donate |

| Lifewater Canada | Thunder Bay, ON | International - Water | Donate |

| Operation Eyesight Universal | Calgary, AB | International - Health | Donate |

For more information on these charities, please view our Top 10 Impact Charities Summary.

To meet Canadian donors’ growing demand for impact charities, Ci also released eight additional lists of charities with top impact:

- Top 10 Canadian Impact Charities, charities with high-impact programs in Canada

- Top 10 International Impact Charities, Canadian charities with high-impact programs operating overseas

- Top 10 Impact: Food Banks, Canadian food banks creating high impact

- Top 10 Impact: Youth Charities, charities creating high-impact results for youth in Canada

- Top 5 Impact: Homeless-Serving Charities, charities creating high-impact results for the homeless in Canada

- Top 5 Calgary Impact Charities

- Top 5 Toronto Impact Charities

- Top 5 Vancouver Impact Charities

Charity Intelligence’s overall star ratings are based on an assessment of five objective aspects: 1. donor reporting, 2. financial transparency, 3. funding need, 4. cents to the cause, and 5. demonstrated impact. The 5-Star rated charities based on all of these metrics combined are listed in Ci’s 2025 100 Highest Rated Charities report.

The demonstrated impact rating looks at only one aspect of charity performance: for every dollar you donate, what’s the measurable return to clients and society? If comparing two charities where one saves lives for $100,000 each and a second charity saves lives for $20,000 each, impact donors will support the second charity that creates five times the impact per dollar. Five lives saved compared with one life for the same donation. Impact donors give for the highest change created from their donations.

Some call Charity Intelligence a “charity watchdog”. We see ourselves as research analysts who help Canadian donors give better. We do hold charities to account for the generous support they receive from Canadian donors and expect them to be financially transparent. We also call out exorbitant overhead costs or charities that don’t need more funding. As well, each giving season we call out the best impact charities we’ve found.

Charity Intelligence’s reports and ratings help Canadians give confidently. With greater confidence, people say they gave 32% more money.

Charity Intelligence’s impact analysis began in 2006 and is an ongoing research project that is generously funded by donors. For more information on our impact assessment please view our Social Impact Ratings Methodology or contact Greg Thomson at This email address is being protected from spambots. You need JavaScript enabled to view it..

If you find Charity Intelligence’s research useful in your giving, please consider donating to support our work. Being entirely funded by donors like you maintains our independence and objectivity to help Canadians be informed in their giving. Canadians donate over $20 billion each year. This giving could achieve tremendous results. We hope Charity Intelligence's research helps Canadians give better.

Legal disclaimer:

The information in this report was prepared by Charity Intelligence Canada from publicly available information. Charity Intelligence and its analysts have endeavoured to ensure that the data in this report is accurate and complete but accepts no liability.

The views and opinions expressed are to inform donors on matters of public interest. Views and opinions are not intended to malign any religion, ethnic group, organization, individual, or anyone or anything. Any dispute arising from your use of this website or viewing the material hereon shall be governed by the laws of the Province of Ontario, without regard to any conflict of law provisions.

“Every investment is an impact investment. The problem is most people don’t know if their investment has positive or negative impact.”

Change to Charity Intelligence's Transparency Metric

Charity Intelligence's transparency metric will change to account for how "transparent" a charity's audited financial statements are. This change will take effect May 1, 2027. It will affect audited financial statements prepared and released after May 1, 2027.

A charity's transparency score will decrease by 1 if the audited financial statements lack full information but instead require a user to access different documents. Charity Intelligence feels that audited financial statements should be a full source of information. Donors shouldn't have to wait and access the T3010 annual filing to fill in the blanks.

This change reflects the purpose of financial statements; "financial statements purpose is to meet the common information needs of external users" (AcSB Accounting Standards for Canadian Non-Profits 1001:01). And further more, "the objective of financial statements is to communicate information that is useful to ... contributors .. in making their resource allocation decisions and/or assessing management stewardship." (Accounting Standard Objective 1001.12)

Examples could include:

Reporting revenues by major sources:

Not reporting government funding

Not disclosing international donations

Reporting spending by activities:

Not reporting administrative costs

Not reporting fundraising costs

Not reporting grants or distributions to other charities separately from total program spending

The figures reported in the audited financial statements should reconcile with the T3010 filings.

Ideally, amortization and interest costs are reported as separate line items on the income statement. Electronic filing is also a best practice. Large charities with over $1 million in total revenues should file their annual returns electronically. Mailing in annual returns puts a huge cost on the CRA Charities Directorate, it causes delays in disclosing information, and greater chance of typos. In contrast, electronic filing is low-cost, faster and better data quality. Charity Intelligence will note those charities that file manually.

We believe this change will improve disclosure and will give donors better information.

Charity Intelligence recognizes that change takes time. We have informed charities of this upcoming policy change in March 2025. We hope two years notice is sufficient.

And every auditor's letter says, "a charity's management is responsibile for the presentation of its financial statements." Canadian charities are empowered to improve transparency.

For reference:

Charity Intelligence's policy change reflects Canadian Accounting Standards' Disclosure of Revenue Recognition,

4411.22 "An organization shall disclose its contributions by major source.

4411.26 Information about the source of contributions will help financial statement users to assess the organization's economic relationship with other entities ... The sources would be grouped by major categories such as

- different levels of government

- foundations

- corporate contributions

- individuals

- and other not-for-profit organizations...."

Charity Intelligence methods for scoring financial transparency

Charity Intelligence video 5 Best Practices for Charity's Audited Financial Statements, YouTube, November 2022