Rating Methodology

.

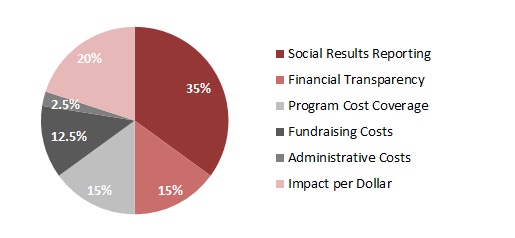

Charities are rated based on:

Components of Ci's Star Ratings

Results reporting has the largest weighting in Charity Intelligence's star rating. To us, this is an indicator of a charity's accountability to donors.

Charities are graded based on the public reporting of their activities, outputs, and outcomes. We get many charity questions about this: the results must be publicly reported. By this, we expect the results will be posted on the charity's website, rather than provided "privately" to selective donors and funders. Ideally the annual results would be in one pdf document making it easier for donors to find rather than having to hunt all over a charity's website. Also, with charity websites undergoing frequent updates, results that are posted on multiple website pages may be accidentally removed or are harder to annually update. One annual report or pdf is easier for charities and donors.

It is important to emphasize that this score does not assess the strength of the charity’s strategy, the quality of its activities, the level of its outputs or the impressiveness of its outcomes; rather, it grades whether enough information is disclosed such that any reader could make those assessments.

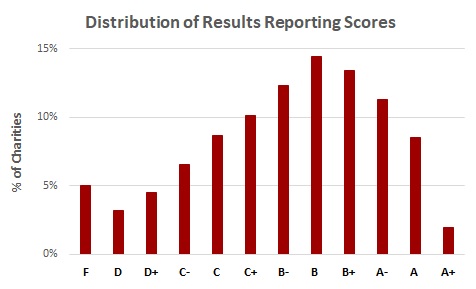

The results reporting grade is based on the relative scoring of the charity compared to all other Canadian charities analyzed. Please click to read more information on how results reporting is graded in Results Reporting.

Charity Intelligence's letter grading is benchmarked relative to all of the charities we analyze. As such, A grades are only for the charities with the highest relative reporting. Current letter grades have the following distribution:

Financial Transparency (15% of Star Rating)

Charities are assessed a rating based on their transparency in providing complete audited financial statements, including the financial notes and accounting policies, to the public. If the most recent statements are not available within 9 months of the charity's year-end, the transparency score is reduced by 1.

| 3 | = | Full marks: Audited financial statements for at least the last 2 years posted on the charity's website. |

| 2 | = | Audited financial statements for the most recent year posted on the charity's website. |

| 1 | = | Charity provided Charity Intelligence with its audited financial statements upon request by email or telephone. |

| 0 | = | No marks: Charity did not provide Charity Intelligence with its audited financial statements upon request. Financial statements were provided by Canada Revenue Agency. |

Program Cost Coverage (15% of Star Rating)

Program cost coverage is a financial ratio tool for assessing a charity’s need for funding. It compares funding reserves (liquid assets of cash, cash equivalents and investments, less interest-bearing liabilities) relative to program costs. The program cost coverage ratio is calculated by dividing the year-end funding reserves (excluding donor-endowed funds) by the program costs for the most recent year less 5% of donor-endowed funds (or the disbursement rate disclosed by the charity), expressed as a percentage.

Charities receive full rating for their need for funding if their program cost coverage ratio is below 300%, meaning that they have less than 3 years’ worth of funds available to fund program costs. Charities with program cost coverage over 500% receive no points for this metric.

Ci's definition of funding reserves includes all funds, whether general, restricted, or endowed. However, in the calculation of the program cost coverage ratio that is factored into the overall star rating, we exclude funds that have been explicitly reported as donor-endowed as well as funds that are explicitly reported for significant, unusual future capital expenditure projects (e.g., a new building) as long as the projected spending on these projects is outlined and dated in the financial statements.

Fundraising Costs (12.5% of Star Rating)

Ci presents all fundraising costs gross of fundraising expenses. Lotteries and business expenses are not included in fundraising ratios. Total fundraising costs are presented as a percent of donations plus special events revenue. Charities receive top points for fundraising costs below 15%. Charities with fundraising ratios above the initial CRA cut-off of 35% receive no points for this metric.

Administrative Costs (2.5% of Star Rating)

The administrative cost ratio is calculated by taking the charity’s total administration costs divided by its total revenues less investment income. Charities require a basic level of administrative costs to operate effectively. If these costs are not adequate, the charity risks being less effective. Given this, charities with administrative cost ratios less than 2% lose 1 out of 5 available points for this metric. Charities with administrative cost ratios between 2% and 12.5% (comprising roughly 2/3 of all charities examined by Ci) receive full points for this metric. Charities with administrative costs above 22.5% receive no points for this metric.

Impact Rating (20% of Star Rating)

To assess impact, Charity Intelligence uses what is known as Social Return on Investment (SROI), which is a ratio that measures the amount of value created per dollar donated. Our Impact Rating assesses charities based on both their demonstrated impact as well as the quality of the data available to assess impact. Additional details on our Impact Ratings can be found here.

Ratings fall into 5 categories based on the combination of demonstrated impact and data quality: High, Good, Average, Fair & Low impact.

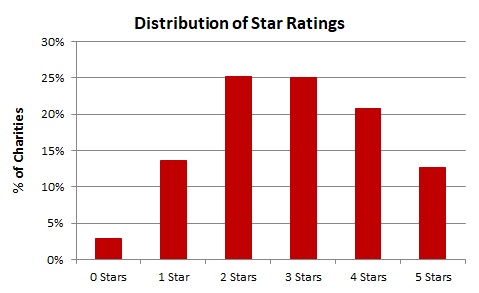

Calculation of Star Ratings

Each of the above metrics is weighted to determine the overall charity score. These final scores are assigned star ratings based on the distribution below. In order to qualify for 3, 4 or 5-Star ratings, charities must also pass the following hurdles:

| 3-Star | 4-Star | 5-Star | |

| Impact Rating | Fair or above | Average or above | Average or above |

| Social Results Reporting | In top 75% of charities | In top 60% of charities | In top 50% of charities |

| Financial Transparency | Rated 1 or above | Rated 2 or above | Rated 2 or above |

| Program Cost Coverage | Below 500% | Below 300% | |

| Fundraising Cost Ratio | Below 42% | Below 30% | |

| Administrative Cost Ratio | Below 35% | Below 30% |

The current distribution of star ratings for all charities rated by Charity Intelligence has the majority at 2 and 3 stars. Charity Intelligence changed from a 4-star rating to 5-star rating in October 2020.

Charity salaries

Charity Intelligence uses the words "salary" and "pay" interchangeably to represent compensation. Here’s the CRA definition of total compensation. It includes "all forms of salaries, wages, commissions, bonuses, fees, and honoraria, plus the value of taxable and non-taxable benefits paid by the charity to its employees. This includes the charity's contribution to the employee's pension, medical or insurance plan, employer Canada Pension Plan/Quebec Pension Plan and employment insurance contributions and workers' compensation premiums." Maybe we should change the profile page and replace "salaries" with "compensation" to be clearer. Please let us know your thoughts on this.

Help us do better work for you! Please fill out our 2025 Visitor survey.

Help us do better work for you! Please fill out our 2025 Visitor survey.