Dalit Freedom Network Canada

STAR RATINGCi's Star Rating is calculated based on the following independent metrics: |

B-

RESULTS REPORTING

Grade based on the charity's public reporting of the work it does and the results it achieves.

Low

DEMONSTRATED IMPACT

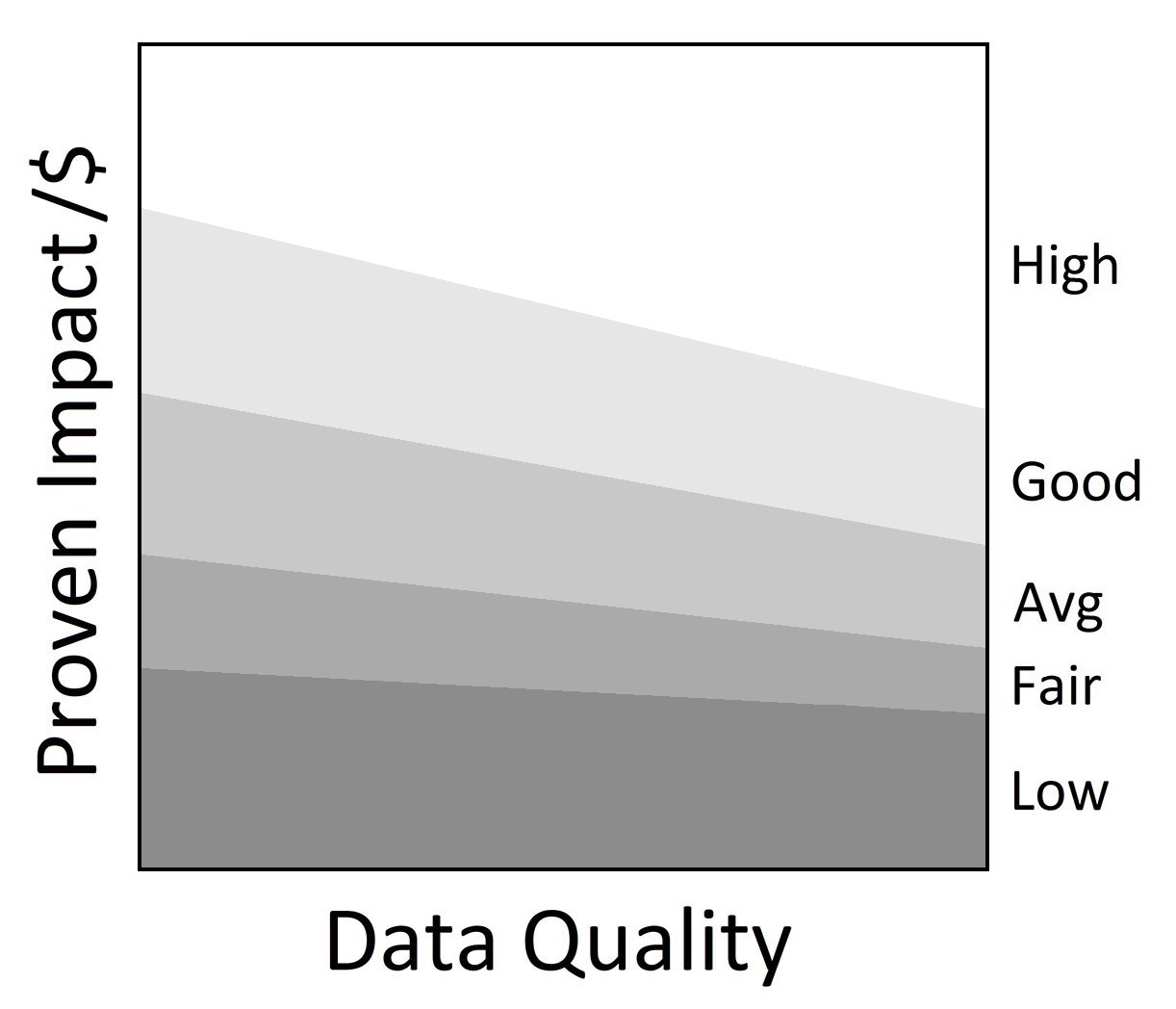

The demonstrated impact per dollar Ci calculates from available program information.

NEED FOR FUNDING

Charity's cash and investments (funding reserves) relative to how much it spends on programs in most recent year.

77%

CENTS TO THE CAUSE

For a dollar donated, after overhead costs of fundraising and admin/management (excluding surplus) 77 cents are available for programs.

My anchor

OVERVIEW

About Dalit Freedom Network Canada:

Founded in 2006, Dalit Freedom Network Canada was a Christian evangelical charity that raised funds to help India’s poor and low caste overcome oppression and become self-reliant through education.

News: Dalit Freedom Network or Dignity Freedom Network closed its operations raising donations in Canada on January 1, 2021.

The low caste people in India are the “broken, downtrodden, or oppressed.” They are born into the lowest level of India’s historical social system and face prejudice, abuse, and exploitation every day. About 250 million men, women, and children face discrimination, segregation, and enforced poverty.

Dalit Freedom Network’s main programs were education sponsorships and school construction, which made up 93% of total program spending in F2017. The charity reports that 21 schools provided education to a total of 7,263 children receiving education sponsorship. In F2017, 9 classrooms were added to two schools which allowed for more children and more grade levels. Dalit also constructed a playground and water well in F2017.

Dalit Freedom Network’s minor programs include women and health initiatives. In F2017, programs for women made up 3% of total program spending, and health initiatives made up 1% of total program spending. Dalit reported that 586 women graduated from the six-month training program at Dalit’s 18 vocational training centres, including 3 new centres. Dalit’s health initiatives provided 107,520 lunches in three needy schools and funded one healthcare worker for a full year.

My anchor

Results and Impact

Dalit Freedom Network reported that 88 women received grants to start income generating businesses in F2017. While Ci highlights this key result, it may not be a complete representation of Dalit’s results and impact.

Charity Intelligence has given Dalit Freedom Network a Low impact rating based on demonstrated impact per dollar spent.

Impact Rating: Low

My anchor

Finances

Dalit Freedom Network is a medium-sized charity, with total donations of $2.7m in F2018. Administrative costs are 14% of revenues and fundraising costs are 9% of donations. For every dollar donated, 77 cents go to the cause. This is within Ci’s reasonable range for overhead spending. Funding reserves of $2.1m can cover 10 months of annual program costs.

This charity report is an update that has been sent to Dalit Freedom Network for review. Changes and edits may be forthcoming.

Updated on July 12, 2019 by Lauren Chin.

Financial Review

Fiscal year ending December

|

2018 | 2017 | 2016 |

|---|---|---|---|

| Administrative costs as % of revenues | 14.0% | 6.3% | 10.1% |

| Fundraising costs as % of donations | 9.2% | 7.1% | 11.5% |

| Total overhead spending | 23.2% | 13.4% | 21.6% |

| Program cost coverage (%) | 87.4% | 88.1% | 46.0% |

Summary Financial StatementsAll figures in $s |

2018 | 2017 | 2016 |

|---|---|---|---|

| Donations | 2,653,279 | 4,626,264 | 3,207,203 |

| Total revenues | 2,653,279 | 4,626,264 | 3,207,203 |

| Program costs - International | 2,244,127 | 2,612,639 | 2,583,869 |

| Program costs - Canada | 162,097 | 223,644 | 256,430 |

| Grants | 257 | 7,666 | 1,025 |

| Administrative costs | 371,072 | 293,096 | 324,529 |

| Fundraising costs | 243,475 | 328,124 | 367,837 |

| Total spending | 3,021,029 | 3,465,168 | 3,533,690 |

| Cash flow from operations | (367,750) | 1,161,096 | (326,487) |

| Capital spending | 1,983 | 175 | 1,783 |

| Funding reserves | 2,102,775 | 2,506,403 | 1,307,416 |

Note: Ci used expense figures from the charity’s T3010 CRA filing. Ci adjusted for amortization on a pro-rata basis from total program, administrative and fundraising costs. Dalit’s income statement reports contributions as the charity’s sole revenue source, which Ci reported in donations. Ci used revenue, expense and asset figures from the charity's T3010 CRA filing for consolidation.

Salary Information

$350k + |

0 |

$300k - $350k |

0 |

$250k - $300k |

0 |

$200k - $250k |

0 |

$160k - $200k |

0 |

$120k - $160k |

0 |

$80k - $120k |

1 |

$40k - $80k |

2 |

< $40k |

4 |

Information from most recent CRA Charities Directorate filings for F2018

My anchor

Comments & Contact

Comments added by the Charity:

Charity Contact

This email address is being protected from spambots. You need JavaScript enabled to view it.

For donors looking to get their tax receipt, please contact info@dignityfreedom.ca or call 1.888.592.2238