Manitoba Possible

STAR RATINGCi's Star Rating is calculated based on the following independent metrics: |

C

RESULTS REPORTING

Grade based on the charity's public reporting of the work it does and the results it achieves.

Low

DEMONSTRATED IMPACT

The demonstrated impact per dollar Ci calculates from available program information.

NEED FOR FUNDING

Charity's cash and investments (funding reserves) relative to how much it spends on programs in most recent year.

86%

CENTS TO THE CAUSE

For a dollar donated, after overhead costs of fundraising and admin/management (excluding surplus) 86 cents are available for programs.

My anchor

OVERVIEW

About Manitoba Possible:

Manitoba Possible is a two-star charity with a low results reporting grade and overhead spending within Ci's reasonable range. The charity is not financially transparent and has funding reserves that can cover less than a year of program costs. Manitoba Possible has low demonstrated imapct.

Founded in 1967, Manitoba Possible is a charity that works to improve the lives of people with disabilities. Before F2020, Manitoba Possible was known as Society for Manitobans with Disabilities. The charity reports that one in six Manitobans has a disability. Manitoba Possible’s main programs are Child Services, Adult Services, Wheelchair Program, Community Inclusion, and Social Enterprise. In F2022, it spent $11.0m on its programs.

In F2022, the charity spent 38% of program spending on Child Services. Child Services provides occupational therapy, physiotherapy, and speech language services to children until they enter school. Therapy is delivered to children at home, in nursery schools and in daycare centres. The Communication Centre for Children helps deaf kids under the age of six communicate with others through American Sign Language, spoken language, and gestures.

Manitoba Possible spent 26% of program spending on Adult Services in F2022. Adult Services includes the Thomson Supportive Employment Program which helps people with disabilities find and maintain a full-time job. The program provides 12 weeks of training seminars to participants followed by 12 weeks of paid work experience in the community of Thomson. The charity also provides life skills counselling, language training, and employment preparation for deaf adults and youth.

In F2022, the charity spent 14% of program spending on its Wheelchair program. The Wheelchair program loans manual and motorized wheelchairs to children and adults in Manitoba.

During the year, Manitoba Possible spent 11% of program spending on Community Inclusion. The Community Inclusion program includes recreation and leisure activities for clients with disabilities. Examples of leisure activities are bowling, dancing, arts and crafts, and theme parties. Community Inclusion also includes a Financial Empowerment program that provides free income tax filing services for low-income people living with disabilities. In F2020, the charity filed 299 tax returns. The remaining 11% of program spending was allocated to Social Enterprise and other programs.

My anchor

Results and Impact

In F2020, Manitoba Possible reports that it helped its clients get $500k in tax refunds and benefits through its Financial Empowerment program. While Ci highlights these key results, they may not be a complete representation of Manitoba Possible's results and impact.

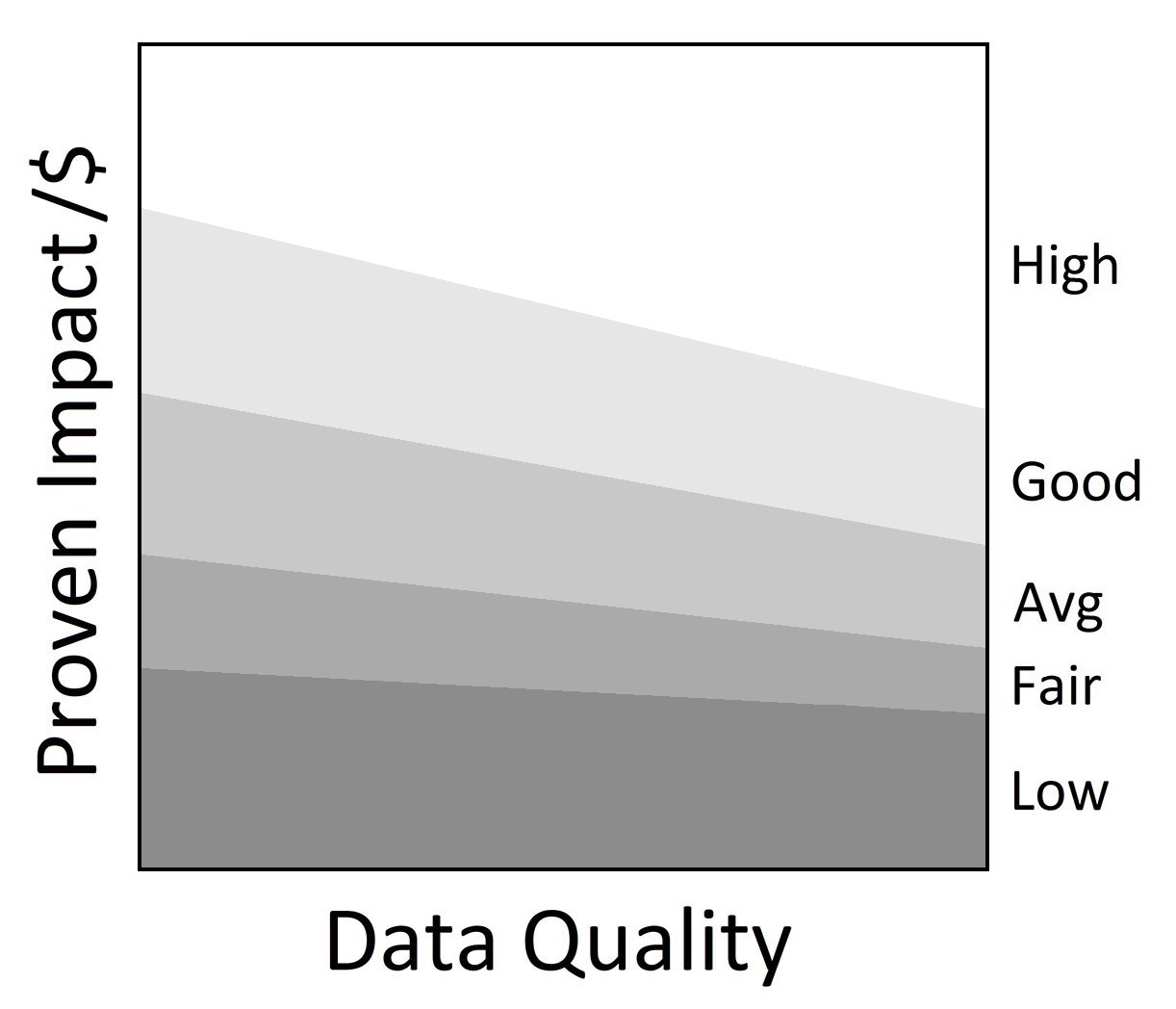

Charity Intelligence has given Manitoba Possible a Low impact rating based on demonstrated impact per dollar spent.

Impact Rating: Low

My anchor

Finances

Ci has consolidated Manitoba Possible with its foundation for the financial analysis.

In F2022, Manitoba Possible received $1.8m in donations and special events revenue. It received $7.9m in government funding (60% of total revenue) and $230k in fees for services (2% of total revenue) during the year. The charity earned $635k in investment income (5% of total revenue), representing a 6% annual return. Its average annual investment return from F2020 to F2022 is around 7%.

Combined administrative and fundraising costs are 14% of total revenue excluding investment income. For every dollar donated to the charity, 86 cents go to the cause. This is within Ci’s reasonable range for overhead spending.

Manitoba Possible has net funding reserves of $12.9m, including $3.0m in donor-endowed funds. Its net funding reserves, excluding donor-endowed funds, can cover program costs for around 11 months.

This charity report is an update that has been sent to Manitoba Possible for review. Changes and edits may be forthcoming.

Updated on August 15th, 2022 by Arjun Kapur.

Financial Review

Fiscal year ending March

|

2022 | 2021 | 2020 |

|---|---|---|---|

| Fundraising & admin costs as % of revenues | 14.1% | 14.2% | 17.9% |

| Total overhead spending | 14.1% | 14.2% | 17.9% |

| Program cost coverage (%) | 90.7% | 93.4% | 75.9% |

Summary Financial StatementsAll figures in $000s |

2022 | 2021 | 2020 |

|---|---|---|---|

| Donations | 1,101 | 1,159 | 1,334 |

| Government funding | 7,868 | 7,786 | 7,916 |

| Fees for service | 230 | 242 | 422 |

| Lotteries (net) | 0 | 0 | 242 |

| Special events | 697 | 515 | 184 |

| Investment income | 635 | 1,324 | 136 |

| Other income | 2,569 | 2,680 | 2,332 |

| Total revenues | 13,100 | 13,707 | 12,567 |

| Program costs | 11,050 | 10,382 | 10,950 |

| Fundraising & administrative costs | 1,759 | 1,755 | 2,223 |

| Other costs | 0 | 0 | 5 |

| Total spending | 12,809 | 12,137 | 13,178 |

| Cash flow from operations | 291 | 1,570 | (611) |

| Capital spending | 108 | 163 | 161 |

| Funding reserves | 12,883 | 12,557 | 11,192 |

Note: Ci adjusted for changes in deferred contributions affecting total revenues by ($153k) in F2022, ($63k) in F2021, and $30k in F2020. Deferred contributions were included in other revenue because the charity's audited financial statements don't separate government deferred contributions from private deferred contributions. Ci included deferred investment income in revenue, affecting total revenues by ($75k) in F2022, $149k in F2021, and ($91k) in F2020. When consolidating the financial statements of Manitoba Possible and Manitoba Possible Foundation, Ci removed any transactions between the two charities from the financial analysis. Donations from the foundation to the operating charity were removed from revenues and expenses, affecting both by ($308k) in F2022, ($156k) in F2021, and ($341k) in F2020.

Salary Information

$350k + |

0 |

$300k - $350k |

0 |

$250k - $300k |

0 |

$200k - $250k |

0 |

$160k - $200k |

0 |

$120k - $160k |

0 |

$80k - $120k |

10 |

$40k - $80k |

0 |

< $40k |

0 |

Information from most recent CRA Charities Directorate filings for F2021

My anchor

Comments & Contact

Comments added by the Charity:

Charity Contact

This email address is being protected from spambots. You need JavaScript enabled to view it. Tel: 204-975-3010