YWCA Toronto

STAR RATINGCi's Star Rating is calculated based on the following independent metrics: |

B

RESULTS REPORTING

Grade based on the charity's public reporting of the work it does and the results it achieves.

Low

DEMONSTRATED IMPACT

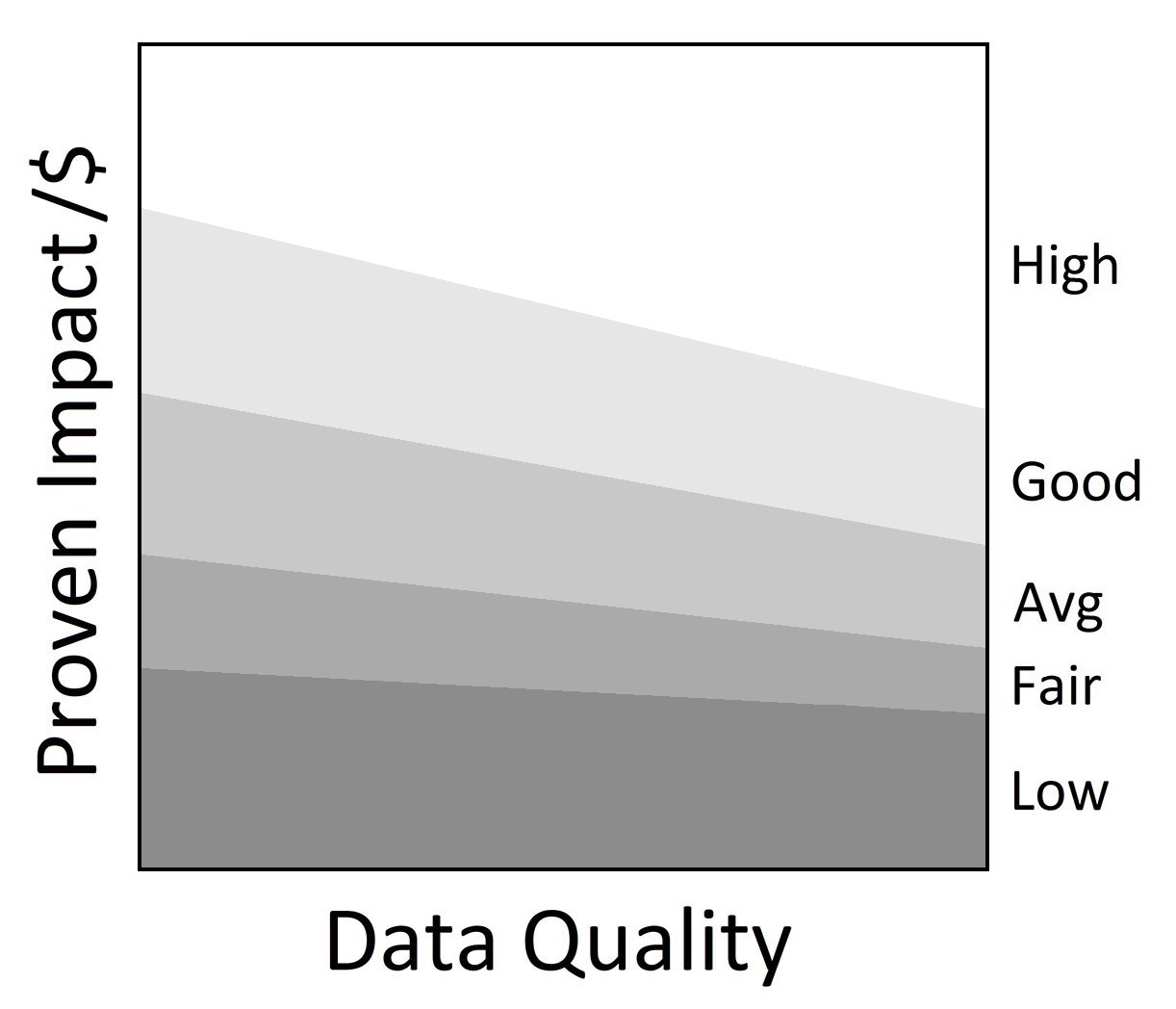

The demonstrated impact per dollar Ci calculates from available program information.

NEED FOR FUNDING

Charity's cash and investments (funding reserves) relative to how much it spends on programs in most recent year.

63%

CENTS TO THE CAUSE

For a dollar donated, after overhead costs of fundraising and admin/management (excluding surplus) 63 cents are available for programs.

My anchor

OVERVIEW

About YWCA Toronto:

YWCA Toronto is a 2-star charity. It has an average results reporting grade but it has Low demonstrated impact and its overhead costs fall outside of Ci's reasonable range.

Founded in 1873, YWCA Toronto works to transform the lives of women in Toronto. It primarily serves disadvantaged women, girls, and gender-diverse people. YWCA Toronto’s clients include women escaping domestic violence, recent immigrants to Canada, single mothers, low-income families, and Indigenous women. YWCA Toronto’s main programs include Housing, Employment, Support, Girls and Family, and Philanthropy.

YWCA Toronto has 667 units of permanent housing, two violence against women shelters, one shelter for homeless women, and one transitional housing project. The charity reports that in F2021 it housed 1,009 people.

YWCA Toronto provides courses on computer skills, English literacy, customer service, and leadership. Clients also gain experience with interviews and resume writing. In F2021, 3,279 people participated in YWCA Toronto employment and training programs. 1,791 people participated in JUMP Scarborough, JUMP Etobicoke, and English language skills programs.

In F2021, 57 infants, toddlers, and preschoolers went to YWCA Toronto’s Bergamot Early Childhood Centre. YWCA Toronto also helped 320 teen moms and families increase social networks and develop confidence and skills to raise healthy children.

YWCA Toronto’s advocacy work focused on an intersectional feminist pandemic recovery in F2021. The charity ran 3 advocacy campaigns with the YWCA Ontario Coalition urging a gender-responsive recovery plan.

My anchor

Results and Impact

YWCA Toronto reports that in F2021 it expanded its engagement with journalists and media publications by 60%. The charity also grew its Twitter presence by 20% and its advocacy e-newsletter The Feminist Edge by 26%.

While Ci highlights these key results, they may not be a complete representation of YWCA Toronto’s results and impact.

Ci has rated YWCA Toronto as Low impact based on demonstrated social impact per dollar spent.

Impact Rating: Low

My anchor

Finances

YWCA Toronto received $4.7m in donations and special event revenue in F2021. The charity received $28.0m in government funding, representing 73% of total revenues. Administrative costs are 11% of total revenues and fundraising costs are 26% of donations. Total overhead spending is 37%. For every dollar donated, 63 cents go to the cause. This falls outside of Ci’s reasonable range for overhead spending.

YWCA Toronto has $12.5m in liquid assets and $60.1m in interest-bearing debts creating a negative program cost coverage ratio. These debts mainly represent mortgages to finance its shelters and facilities. Excluding debts, YWCA Toronto could cover 39% or five months of program costs.

YWCA Toronto paid external fundraisers $17k in F2021 to raise $24k for a cost of 70 cents per dollar raised.

This charity profile is an update that has been sent to YWCA Toronto for review. Changes and edits may be forthcoming.

Updated on June 21, 2021 by Emily Downing.

Financial Review

Fiscal year ending December

|

2021 | 2020 | 2019 |

|---|---|---|---|

| Administrative costs as % of revenues | 10.5% | 10.8% | 12.3% |

| Fundraising costs as % of donations | 26.4% | 20.9% | 30.7% |

| Total overhead spending | 36.9% | 31.7% | 43.0% |

| Program cost coverage (%) | (148.1%) | (82.8%) | (97.5%) |

Summary Financial StatementsAll figures in $000s |

2021 | 2020 | 2019 |

|---|---|---|---|

| Donations | 4,165 | 4,504 | 3,344 |

| Government funding | 28,005 | 24,755 | 22,895 |

| Fees for service | 106 | 79 | 1,102 |

| Business activities (net) | 4,198 | 4,248 | 4,458 |

| Special events | 520 | 289 | 668 |

| Investment income | 1,107 | 824 | 998 |

| Other income | 404 | 310 | 337 |

| Total revenues | 38,505 | 35,009 | 33,803 |

| Program costs | 32,103 | 27,907 | 26,639 |

| Administrative costs | 3,923 | 3,692 | 4,033 |

| Fundraising costs | 1,238 | 1,002 | 1,232 |

| Total spending | 37,264 | 32,602 | 31,904 |

| Cash flow from operations | 1,241 | 2,407 | 1,899 |

| Capital spending | 2,669 | 589 | 410 |

| Funding reserves | (47,552) | (23,102) | (25,985) |

Note: Ci adjusted for amounts received for restricted capital and amortization of deferred capital contributions, affecting Canadian donations by ($618k) in F2021, ($11k) in F2020, and ($617k) in F2019. Ci reported Women of Distinction fundraising revenues as special event revenue. Ci removed amortization of deferred capital contributions from government revenue, affecting total revenues by $947k in F2021, $933k in F2020, and $916k in F2019. Ci removed amortization of deferred capital contributions from fees and rent, affecting total revenues by ($28k) in F2021, ($23k) in F2020, and ($22k) in F2021. Ci removed interest income on below market loans from government funding and reported it as interest income. Ci removed unit repairs funded by capital replacement reserves, affecting total revenues by $0 in F2021, $23k in F2020, and $10k in F2019.

Salary Information

$350k + |

0 |

$300k - $350k |

0 |

$250k - $300k |

0 |

$200k - $250k |

1 |

$160k - $200k |

0 |

$120k - $160k |

1 |

$80k - $120k |

8 |

$40k - $80k |

0 |

< $40k |

0 |

Information from most recent CRA Charities Directorate filings for F2021

My anchor

Comments & Contact

Comments added by the Charity:

Charity Contact

This email address is being protected from spambots. You need JavaScript enabled to view it. Tel: 416-961-8100