Calgary Drop-in

STAR RATINGCi's Star Rating is calculated based on the following independent metrics: |

✔+

FINANCIAL TRANSPARENCY

Audited financial statements for current and previous years available on the charity’s website.

A-

RESULTS REPORTING

Grade based on the charity's public reporting of the work it does and the results it achieves.

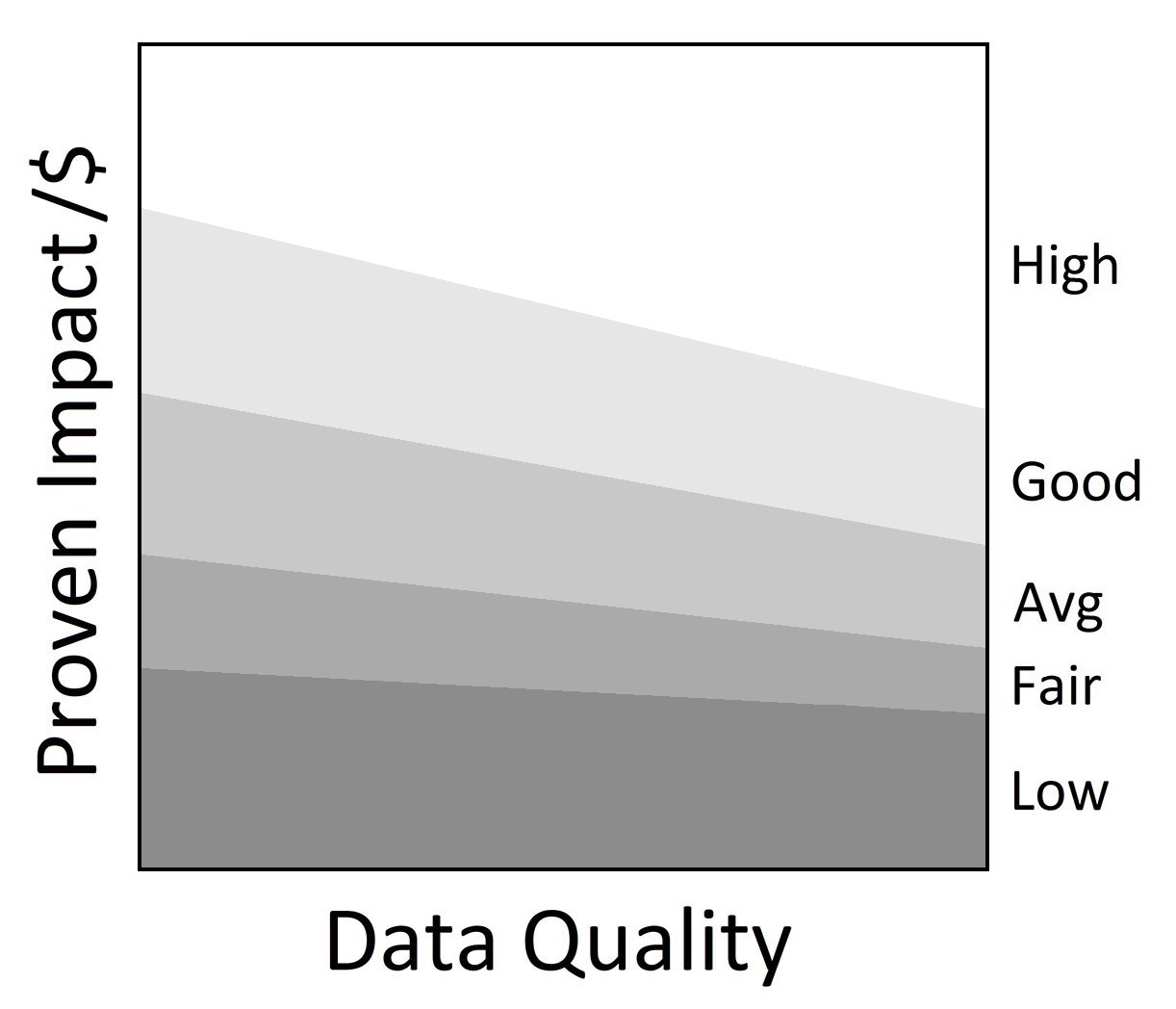

Average

DEMONSTRATED IMPACT

The demonstrated impact per dollar Ci calculates from available program information.

NEED FOR FUNDING

Charity's cash and investments (funding reserves) relative to how much it spends on programs in most recent year.

90%

CENTS TO THE CAUSE

For a dollar donated, after overhead costs of fundraising and admin/management (excluding surplus) 90 cents are available for programs.

My anchor

OVERVIEW

About Calgary Drop-in:

Calgary Drop-In Centre is a 4-star charity with Average demonstrated impact. It has a very good results reporting grade and is financially transparent. The charity has negative net funding reserves due to its $12m in debt, showing a need for donations.

Established in 1961, Calgary Drop-In Centre (Calgary DI) helps adults at risk of or experiencing homelessness. Calgary DI identifies as a housing-focused emergency shelter. Calgary DI views its emergency shelter as a temporary solution and focuses on helping people exit homelessness and find independent living accommodations. Calgary DI runs programs such as emergency shelter, housing, free goods, and employment services.

Calgary Drop-In’s emergency shelter programs and covid response ($17.8 million of program spending or 62% of program spending) provide access to food, beds, health services, housing support, hygiene services, clothing, and employment services. In F2022, the charity served an average of 446 people each day. Calgary DI served a total of 592,384 meals and served 4,416 unique individuals at the shelter.

Through its housing programs, ($4.4 million of program spending 15%) Calgary DI works one-on-one with homeless people to find them permanent homes. The charity also provides housing resources for clients to access. In F2022, Calgary DI supported 36 people during its health and resource day, and it connected 21 people to housing supports.

The Calgary Free Goods Program ($0.9 million of program spending, 3%) provides people with items for their homes, including furniture, kitchenware, computers, mobile phones, small appliances, books, and more. In F2022, Calgary DI provided 191,091 household items to 7,191 people.

Calgary DI helps homeless people get back to work through free employment services training. Courses include Workplace Hazardous Materials Information System (WHMIS), Standard First Aid, Forklift Operational & Safety, and more.

Calgary DI also gave 2,733 doses of Naloxone and provided 29,176 health clinic appointments in F2022. Calgary DI's health program is $0.3 million of program spending, 1%.

My anchor

Results and Impact

In F2022, Calgary Drop-In Centre helped 121 people quickly exit homelessness with alternative housing and supports provided. Calgary DI reports that it successfully housed 358 individuals of which 96% remained independently housed with a 3.8% return to shelter rate in F2022.

While Charity Intelligence highlights these key results, they may not be a complete representation of Calgary Drop-In Centre’s results and impact.

Charity Intelligence gave the Calgary Drop-In Centre an impact rating of Average for demonstrated impact per dollar spent.

Impact Rating: Average

My anchor

Finances

In F2022, Calgary Drop-In Centre had total donations of $5.9m. The charity received $22.0m in government funding, representing 67% of total revenues. The charity also collected $2.8m in rental revenue. Administrative costs are 6% of revenues and fundraising costs are 4% of donations. This results in total overhead spending of 10%. For every dollar donated, 90 cents go to the cause, which is inside Ci’s reasonable range for overhead spending.

Calgary DI has ($193k) in funding reserves, due to the possession of $12.3m in debt. Excluding debt, Calgary DI could cover just under 6 months of annual program costs with reserves.

Charity Intelligence sent an update of this report to Calgary Drop-In Centre for review. Changes and edits may be forthcoming.

Updated on September 26, 2022 by Emma Saganowich.

Financial Review

Fiscal year ending March

|

2022 | 2021 | 2020 |

|---|---|---|---|

| Administrative costs as % of revenues | 5.6% | 3.6% | 4.6% |

| Fundraising costs as % of donations | 4.0% | 2.4% | 9.7% |

| Total overhead spending | 9.6% | 5.9% | 14.2% |

| Program cost coverage (%) | (0.8%) | (11.6%) | (69.7%) |

Summary Financial StatementsAll figures in $000s |

2022 | 2021 | 2020 |

|---|---|---|---|

| Donations | 5,925 | 8,296 | 2,583 |

| Goods in kind | 1,805 | 1,761 | 2,922 |

| Government funding | 22,037 | 26,352 | 14,603 |

| Fees for service | 2,758 | 2,740 | 2,150 |

| Investment income | 54 | 40 | 97 |

| Other income | 198 | 1,001 | 270 |

| Total revenues | 32,776 | 40,190 | 22,625 |

| Program costs | 24,586 | 30,263 | 18,353 |

| Donated goods exp | 1,805 | 1,761 | 2,922 |

| Administrative costs | 1,845 | 1,424 | 1,024 |

| Fundraising costs | 236 | 198 | 250 |

| Other costs | 199 | 285 | 193 |

| Total spending | 28,670 | 33,931 | 22,742 |

| Cash flow from operations | 4,106 | 6,259 | (117) |

| Capital spending | 1,241 | 1,024 | 3,985 |

| Funding reserves | (193) | (3,519) | (12,798) |

Note: Ci included additions to deferred contributions in government funding and did not include amortization of deferred contributions. This affected total revenues by ($352k) in F2022, ($850k) in F2021, and ($2.1m) in F2020. Ci used the charity’s T3010 filing with the CRA to report administrative and fundraising costs.

Salary Information

$350k + |

0 |

$300k - $350k |

0 |

$250k - $300k |

0 |

$200k - $250k |

1 |

$160k - $200k |

2 |

$120k - $160k |

2 |

$80k - $120k |

5 |

$40k - $80k |

0 |

< $40k |

0 |

Information from most recent CRA Charities Directorate filings for F2022

My anchor

Comments & Contact

Comments added by the Charity:

The following comments have been previously added by the charity before 2021. New comments may be coming.

Whether housed or unhoused, the DI is open to care for our community’s most vulnerable and get them connected to housing. Rooted in community and fueled by kindness, the DI proudly serves as part of the Calgary Homeless Foundation’s Homeless-Serving System of Care.

The DI helps people find housing:

The DI helps people with basic needs:

The DI helps empower people:

The DI helps the community get involved:

Charity Contact

This email address is being protected from spambots. You need JavaScript enabled to view it. Tel: 403-266-3600