MADD Canada

STAR RATINGCi's Star Rating is calculated based on the following independent metrics: |

✔+

FINANCIAL TRANSPARENCY

Audited financial statements for current and previous years available on the charity’s website.

A-

RESULTS REPORTING

Grade based on the charity's public reporting of the work it does and the results it achieves.

Low

DEMONSTRATED IMPACT

The demonstrated impact per dollar Ci calculates from available program information.

NEED FOR FUNDING

Charity's cash and investments (funding reserves) relative to how much it spends on programs in most recent year.

71%

CENTS TO THE CAUSE

For a dollar donated, after overhead costs of fundraising and admin/management (excluding surplus) 71 cents are available for programs.

My anchor

OVERVIEW

About MADD Canada:

MADD Canada is a 2-star rated, financially transparent charity. It has an above average results reporting grade and is rated Low for demonstrated impact. Its overhead spending is within Ci’s reasonable range. MADD Canada has $8.6m in reserve funds, which can cover 1.6 years of program costs.

Founded in 1989 as Mothers Against Drunk Driving (MADD), MADD Canada’s mission is to stop impaired driving and support its victims. The charity states that laws have been insufficient in eliminating drunk driving and that often, drunk drivers carry passengers with them. In March 2022, MADD Canada ran its National Survey on Driving After Alcohol, Cannabis or Illicit Drug Use. The survey found that amongst the 67% of drivers who used alcohol, 6% drove in the last six months while impaired, and 35% of those had a passenger. In 2019, there were 86,964 federal charges and provincial/territorial short term licence suspensions for impaired driving. This averages to 238 charges and suspensions daily.

MADD Canada’s three main programs are Public Education, Awareness and Research, Youth Services and Victim and Survivor Services.

Public Education, Awareness and Research – 91% of program spending

MADD Canada works to spread awareness of the dangers of impaired driving through campaigns, public service announcements (PSAs) and public engagement. In F2022, MADD Canada distributed about 165,000 red ribbons and red ribbon car decals. These serve as reminders of the dangers and consequences of driving under the influence. It also distributed over 50,000 bookmarks to its Chapters and Community Leaders to be handed out during the Project Red Ribbon campaign. In F2022, MADD Canada received $26.7m in donated airtime. It aired its television PSAs over 109,000 times, and its radio PSAs thousands of times, reaching millions of Canadians. The charity reports that its printed newsletter reached an average of 4,850 readers per issue and the digital one reached 65,000 recipients per issue. MADD Canada also focuses on public policy. The charity lobbies for changes to legislation and creates policy and legislative recommendations.

Youth Services – 8% of program spending

MADD Canada highlights that young people are at high risk of being involved in an impaired driving accident. The charity reports that substances are involved in over 50% of road crash deaths among 16 to 25 year olds. MADD Canada presents programs in schools to raise awareness about these risks. In F2022, the charity presented its SmartWheels program 803 times at 182 elementary schools. It presented its English and French school programs “The Wish” and “Précipice” 2,751 times at 829 middle and high schools. It presented its “Weed Out the Risk” presentation 962 times at 212 high schools. MADD awarded bursaries to nine post-secondary students affected by impaired driving.

Victim and Survivor Services – 2% of program spending

MADD Canada provides resources to help those that have been affected by impaired driving. In F2022, the charity reports having 1,831 contacts with victims. It adds that over 185 victims and survivors used MADD Canada’s services for the first time. The charity reports that it hosted over 75 online support group meetings, with over 430 registrants.

My anchor

Results and Impact

In F2021, MADD Canada conducted a survey of students having attended a school presentation. Following the presentations, 83% of students said they were not likely to ride with someone who had consumed alcohol or drugs. 83% said they were very likely to make a plan to get home safe when going out with friends. 95% felt encouraged to make the right decision when it comes to impaired driving.

MADD Canada lobbies for tougher impaired driving laws. With support from MADD, the Alberta government created a new impaired driving legislation, Bill-22. This legislation includes immediate roadside sanctions for drivers over the blood alcohol concentration limit.

While Charity Intelligence highlights these key results, they may not be a complete representation of MADD Canada's results.

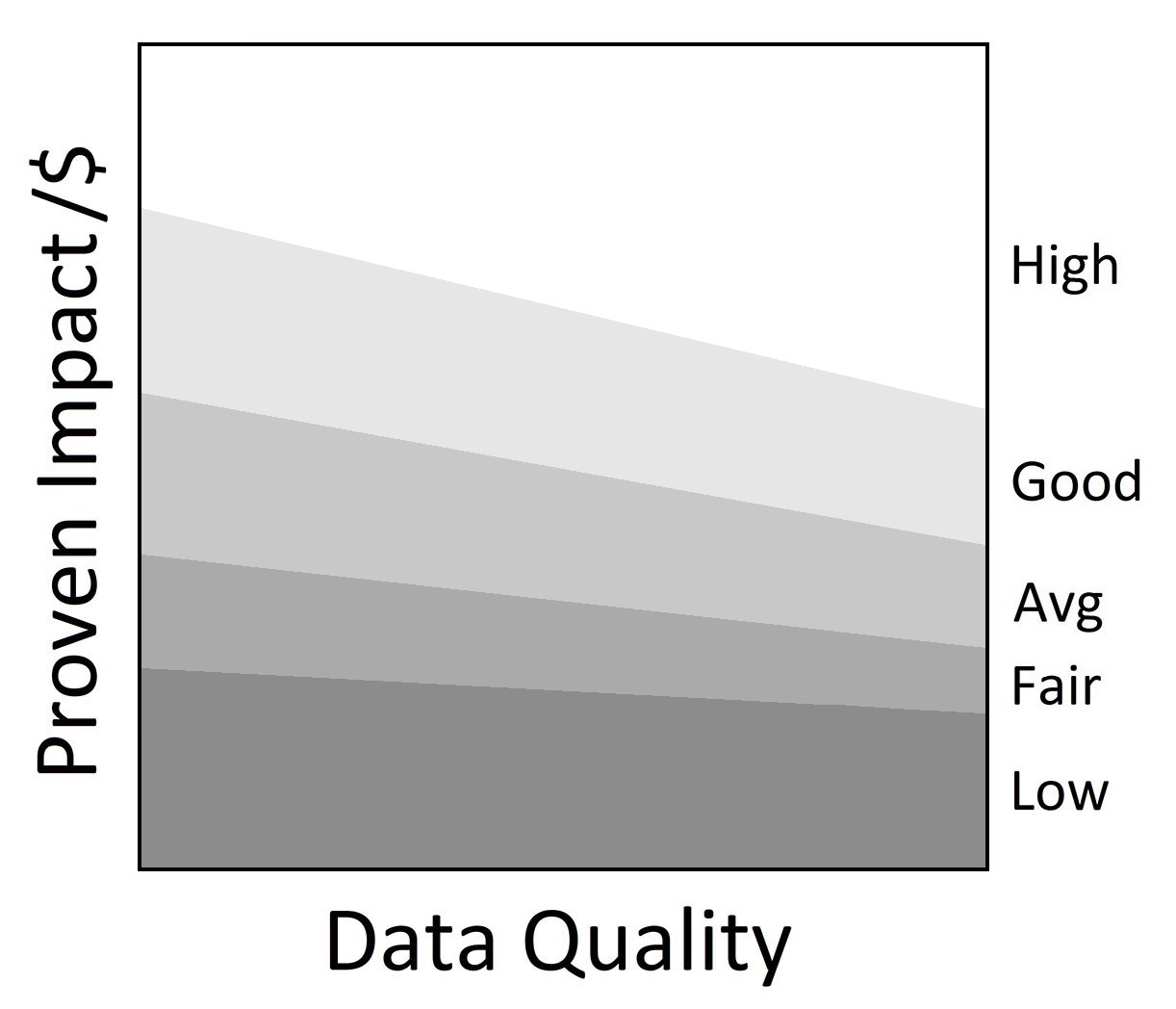

Charity Intelligence has given MADD Canada a Low impact rating based on demonstrated impact per dollar spent.

Impact Rating: Low

My anchor

Finances

MADD Canada had cash donations of $8.7m in F2022. Administrative costs are 1% of total revenues and fundraising costs are 28% of cash donations. This results in total overhead spending of 29%. This means that for every dollar donated, 71 cents are available for programs. This is within Ci’s reasonable range for overhead spending.

MADD’s total revenues and program spending include $26.7m in donated airtime for public service announcements in F2022. These are shown below as donated goods in kind.

MADD Canada has funding reserves of $8.6m. Not including donated airtime, the reserves can cover 165% or roughly a year and eight months of annual program costs.

In F2022, MADD Canada paid external fundraisers $1.8m who collected $3.7m in donations. This means it costs MADD Canada $0.49 to raise $1 using external fundraisers.

This charity report is an update that has been sent to MADD Canada for review. Changes and edits may be forthcoming.

Updated on June 15 2023, by Victoria Allder.

Financial Review

Fiscal year ending March

|

2022 | 2021 | 2020 |

|---|---|---|---|

| Administrative costs as % of revenues | 1.4% | 2.0% | 2.1% |

| Fundraising costs as % of donations | 27.8% | 37.0% | 29.2% |

| Total overhead spending | 29.2% | 39.0% | 31.3% |

| Program cost coverage (%) | 164.5% | 172.9% | 102.9% |

Summary Financial StatementsAll figures in $000s |

2022 | 2021 | 2020 |

|---|---|---|---|

| Donations | 8,740 | 6,565 | 8,837 |

| Goods in kind | 26,748 | 14,848 | 13,111 |

| Government funding | 165 | 689 | 390 |

| Fees for service | 6 | 4 | 21 |

| Lotteries (net) | 163 | 133 | 151 |

| Investment income | 180 | 621 | (154) |

| Other income | 74 | 8 | 2 |

| Total revenues | 36,077 | 22,867 | 22,358 |

| Program costs | 5,240 | 4,303 | 6,024 |

| Grants | 1 | 1 | 1 |

| Donated goods exp | 26,748 | 14,848 | 13,111 |

| Administrative costs | 500 | 448 | 461 |

| Fundraising costs | 2,426 | 2,430 | 2,581 |

| Total spending | 34,915 | 22,029 | 22,178 |

| Cash flow from operations | 1,162 | 838 | 181 |

| Capital spending | 0 | 9 | 472 |

| Funding reserves | 8,620 | 7,442 | 6,199 |

Note: Ci adjusted for non-government deferred revenue, contributions restricted for capital assets and amortization of deferred capital contributions. This affected donations by $233k in F2022, ($1.6m) in F2021 and ($86k) in F2020. Ci gathered grant figures from the charity’s T3010 CRA filings and backed the amounts out of program costs. This affected program costs by ($1k) in F2022, ($1k) in F2021 and ($1k) in F2020. Ci removed amortization from program costs, affecting them by ($451k) in F2022, ($268k) in F2021 and ($288k) in F2020. Amortization is mostly related to vehicles used in programs.

Salary Information

$350k + |

0 |

$300k - $350k |

0 |

$250k - $300k |

0 |

$200k - $250k |

1 |

$160k - $200k |

1 |

$120k - $160k |

2 |

$80k - $120k |

6 |

$40k - $80k |

0 |

< $40k |

0 |

Information from most recent CRA Charities Directorate filings for F2022

My anchor

Comments & Contact

Comments added by the Charity:

MADD Canada provided the comment below to a previous profile. Updated comments from the charity may be forthcoming:

MADD Canada is one of the leading charitable organizations on financial transparency. MADD Canada each year puts on its website (madd.ca) its approved budget, audited financial statements and its charitable tax return filed with the Canada Revenue Agency. MADD Canada’s goal each year is to spend 65% of its revenues on its charitable programs and keep its fundraising and administrative expenses below 35%. Some of the information completed by Charity Intelligence Canada (Ci) on MADD Canada requires further details and clarifications.

Average Compensation:

This average compensation formula used by Ci includes both salary and benefit costs. So the reader must be aware that the average compensation in MADD Canada’s case is higher by 18% to reflect the costs of benefits provided by MADD Canada to its employees. The formula used by Ci only averages the 18 full-time employees so the average compensation is much higher than it would be if all MADD Canada staff were included in the formula used by Ci.

Funding Reserves:

MADD Canada’s net assets were $4,017,005 as of March 31, 2018. There are three components that make up MADD Canada’s net assets. One, MADD Canada Chapters and Community Leaders have net assets of $1,406,278. Two, MADD Canada has a Victim Bursary Fund of $492,510 which provides post-secondary scholarships to students whose parent/guardian/sibling were killed in an impaired driving crash. Three, MADD Canada has general operating reserves of $2,118,217.

Charity Contact

This email address is being protected from spambots. You need JavaScript enabled to view it. Tel: 905-829-8805