Conam Charitable Foundation

STAR RATINGCi's Star Rating is calculated based on the following independent metrics: |

✖

FINANCIAL TRANSPARENCY

Audited financial statements available only through official request for information from Charities Directorate.

F

RESULTS REPORTING

Grade based on the charity's public reporting of the work it does and the results it achieves.

Low

DEMONSTRATED IMPACT

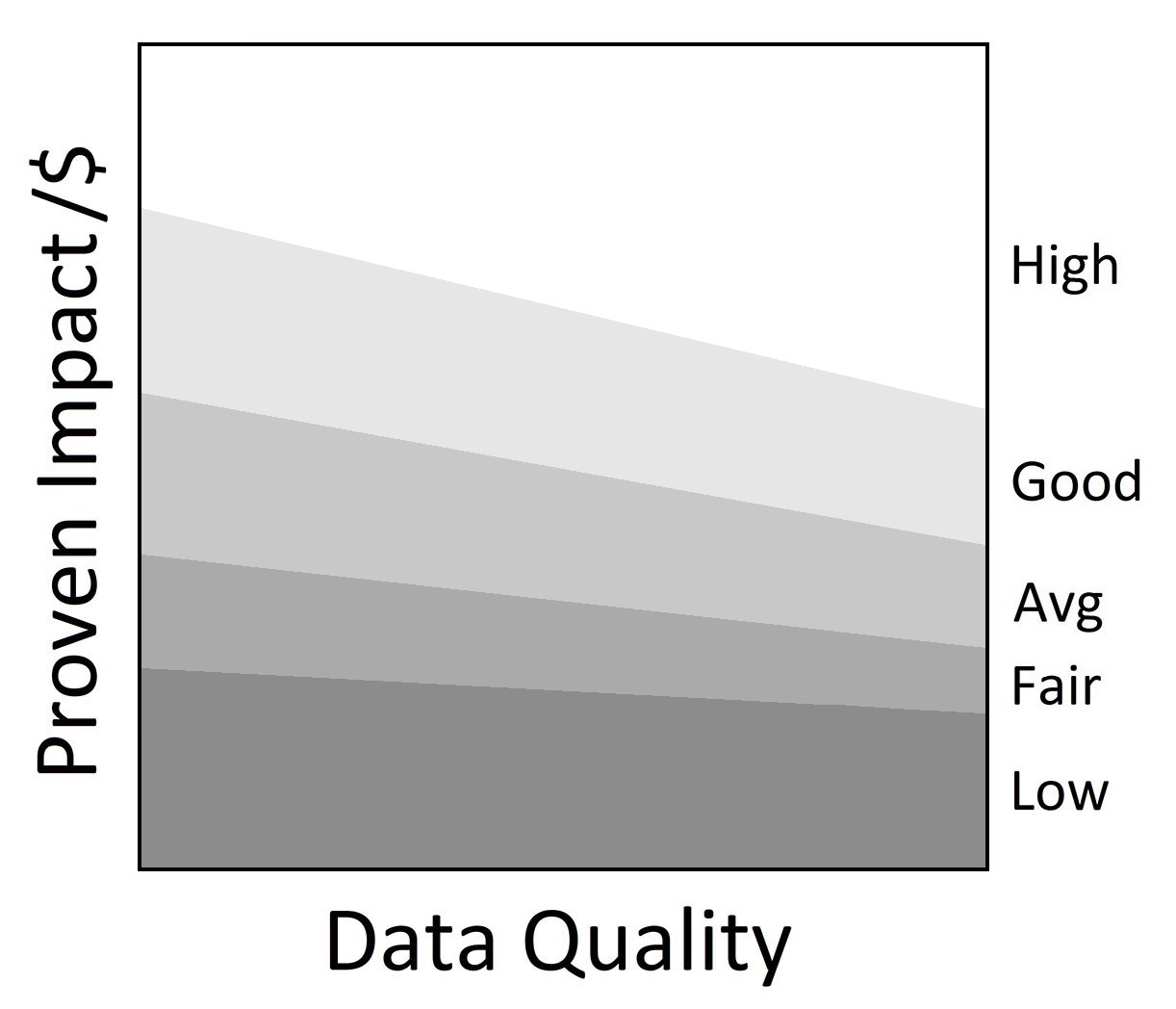

The demonstrated impact per dollar Ci calculates from available program information.

NEED FOR FUNDING

Charity's cash and investments (funding reserves) relative to how much it spends on programs in most recent year.

81%

CENTS TO THE CAUSE

For a dollar donated, after overhead costs of fundraising and admin/management (excluding surplus) 81 cents are available for programs.

My anchor

OVERVIEW

About Conam Charitable Foundation:

Conam Charitable Foundation is a 0-star charity. It is not financially transparent and has a Low demonstrated impact. It has reasonable overhead costs and with its current reserves it can cover five months of annual program costs. The charity has an F grade in results reporting meaning that it provides almost no results information for donors.

Registered in 2007 with the CRA, Conam Charitable Foundation facilitates flow-through share donations to donor-advised Canadian charities. Flow-through shares are special shares of mining, oil, and other energy companies that are eligible for tax benefits. Combining these tax benefits with charitable donation tax benefits allows donors to reduce the after-tax cost of giving.

The Foundation does not report any contact or compensation information in its T3010 CRA filings. Charity Intelligence could not find a website for further details about the charity.

According to Conam Charitable Foundation’s T3010 filing, Conam received $63.1m in donations in F2022. This makes Conam one of the biggest charities in Canada, and similar in size to charities such as United Way Montreal and United Way Calgary.

In F2022, Conam granted $51.1m to 639 registered charities and qualified donees. The five largest grant recipients in F2022 were: Charitable Gift Funds Canada ($6.4m), Jewish Community Foundation of Montreal ($3.6m), Scotia Capital Fund ($2.0m), Atid Charitable Foundation ($1.2m), and Butter Cup Foundation ($1.0m).

Other than the reported grants, the only significant cost item reported on the T3010 is $11.8m in professional and consulting fees. These are fees paid to financial companies for brokerage services.

My anchor

Results and Impact

Charity Intelligence did not find any quantified outcomes reported on Conam Charitable Foundation.

Charity Intelligence gave Conam Charitable Foundation an impact rating of Low for proven impact per dollar.

Impact Rating: Low

My anchor

Finances

Conam Charitable Foundation is not financially transparent. The following financial analysis is based on Conam’s F2022, F2021 and F2020 unaudited financial statements provided to Ci from the CRA. As such, no financial notes or further breakdown of the figures below were provided.

Conam Charitable Foundation is a Major 100 charity with $63.1m in donations in F2022. Administrative costs are 19% of revenues (less investment income) and fundraising costs are less than 1% of donations. This results in total overhead spending of 19%. For every dollar donated, 81 cents go to the cause. This is within Ci’s reasonable range for overhead spending.

In F2022, Conam Charitable Foundation has $21.6m in reserve funds, an increase of 66% from F2020 ($13.1m in F2020). Reserve funds are the charity’s cash and investments. The charity could cover 42% or five months of granting at the F2022 level with current reserves.

This charity report is an update that has been sent to Conam Charitable Foundation for review. Changes and edits may be forthcoming.

Updated on June 30, 2023 by Alessandra Castino.

Financial Review

Fiscal year ending June

|

2022 | 2021 | 2020 |

|---|---|---|---|

| Administrative costs as % of revenues | 18.7% | 19.4% | 16.5% |

| Fundraising costs as % of donations | 0.0% | 0.0% | 0.0% |

| Total overhead spending | 18.7% | 19.4% | 16.5% |

| Program cost coverage (%) | 42.4% | 37.3% | 29.0% |

Summary Financial StatementsAll figures in $000s |

2022 | 2021 | 2020 |

|---|---|---|---|

| Donations | 63,102 | 81,778 | 61,705 |

| Investment income | 98 | 127 | 172 |

| Total revenues | 63,200 | 81,905 | 61,877 |

| Grants | 51,073 | 58,800 | 45,038 |

| Administrative costs | 11,826 | 15,851 | 10,191 |

| Fundraising costs | 2 | 0 | 21 |

| Other costs | 6 | 4 | 4 |

| Total spending | 62,907 | 74,655 | 55,253 |

| Cash flow from operations | 293 | 7,250 | 6,624 |

| Capital spending | 0 | 0 | 0 |

| Funding reserves | 21,634 | 21,930 | 13,068 |

Salary Information

$350k + |

0 |

$300k - $350k |

0 |

$250k - $300k |

0 |

$200k - $250k |

0 |

$160k - $200k |

0 |

$120k - $160k |

0 |

$80k - $120k |

0 |

$40k - $80k |

0 |

< $40k |

0 |

Information from most recent CRA Charities Directorate filings for F2022

My anchor

Comments & Contact

Comments added by the Charity:

Charity Contact

This email address is being protected from spambots. You need JavaScript enabled to view it.