Easter Seals British Columbia/Yukon

STAR RATINGCi's Star Rating is calculated based on the following independent metrics: |

✔+

FINANCIAL TRANSPARENCY

Audited financial statements for current and previous years available on the charity’s website.

B+

RESULTS REPORTING

Grade based on the charity's public reporting of the work it does and the results it achieves.

Low

DEMONSTRATED IMPACT

The demonstrated impact per dollar Ci calculates from available program information.

NEED FOR FUNDING

Charity's cash and investments (funding reserves) relative to how much it spends on programs in most recent year.

48%

CENTS TO THE CAUSE

For a dollar donated, after overhead costs of fundraising and admin/management (excluding surplus) 48 cents are available for programs.

My anchor

OVERVIEW

About Easter Seals British Columbia/Yukon:

Easter Seals British Columbia and Yukon is a two-star charity that is financially transparent and has an average results reporting grade. Its overhead costs are outside of Ci's reasonable range and its programs have low demonstrated impact resulting in a low star rating.

Founded in 1947, Easter Seals British Columbia and Yukon (Easter Seals BC/Yukon) is a service of the British Columbia Lions Society for Children with Disabilities. The charity aims to improve the quality of life for people with disabilities of all ages. It reports that in British Columbia, 926,100 people aged 15 to 64 have a disability that limits their independence and quality of life. Easter Seals BC/Yukon’s main charitable programs are summer camps and Easter Seals House. In F2021 it spent $2.0m on programs.

In F2021, Easter Seals BC/Yukon spent $1.0m on its summer camps, representing 50% of total program spending. This program offers outdoor day camps, overnight camps, and online camps for children and young adults with physical or cognitive disabilities. Easter Seals BC/Yukon owns three camp locations: Camp Shawnigan on Vancouver Island, Camp Squamish north of Vancouver, and Camp Winfield in the Okanagan Valley. In F2021, the charity had 567 virtual camp days, 21 days of outdoor camping, 7 art classes, and 6 music and dance classes. During the year, 92 people attended outdoor camp, and 106 people attended family camp.

The charity spent $804k on Easter Seals House in F2021, representing 40% of total program spending. The Easter Seals House provides out-of-town families with affordable housing while their children get medical treatment in Vancouver. The house has 49 suites, each with a private washroom and kitchen. During the year, the house had 18,349 total guest stays.

It spent the remaining $184k on marketing and program development, representing 9% of total program spending.

My anchor

Results and Impact

Easter Seals BC/Yukon reports that 62% of its outdoor adventure day campers were more independent after attending the camp, and 58% of day campers had improved confidence. It also reports that 92% of its family camp attendees had achieved personal development by attending the camp.

While Charity Intelligence highlights these key results, they may not be a complete representation of Easter Seals BC/Yukon’s results and impact.

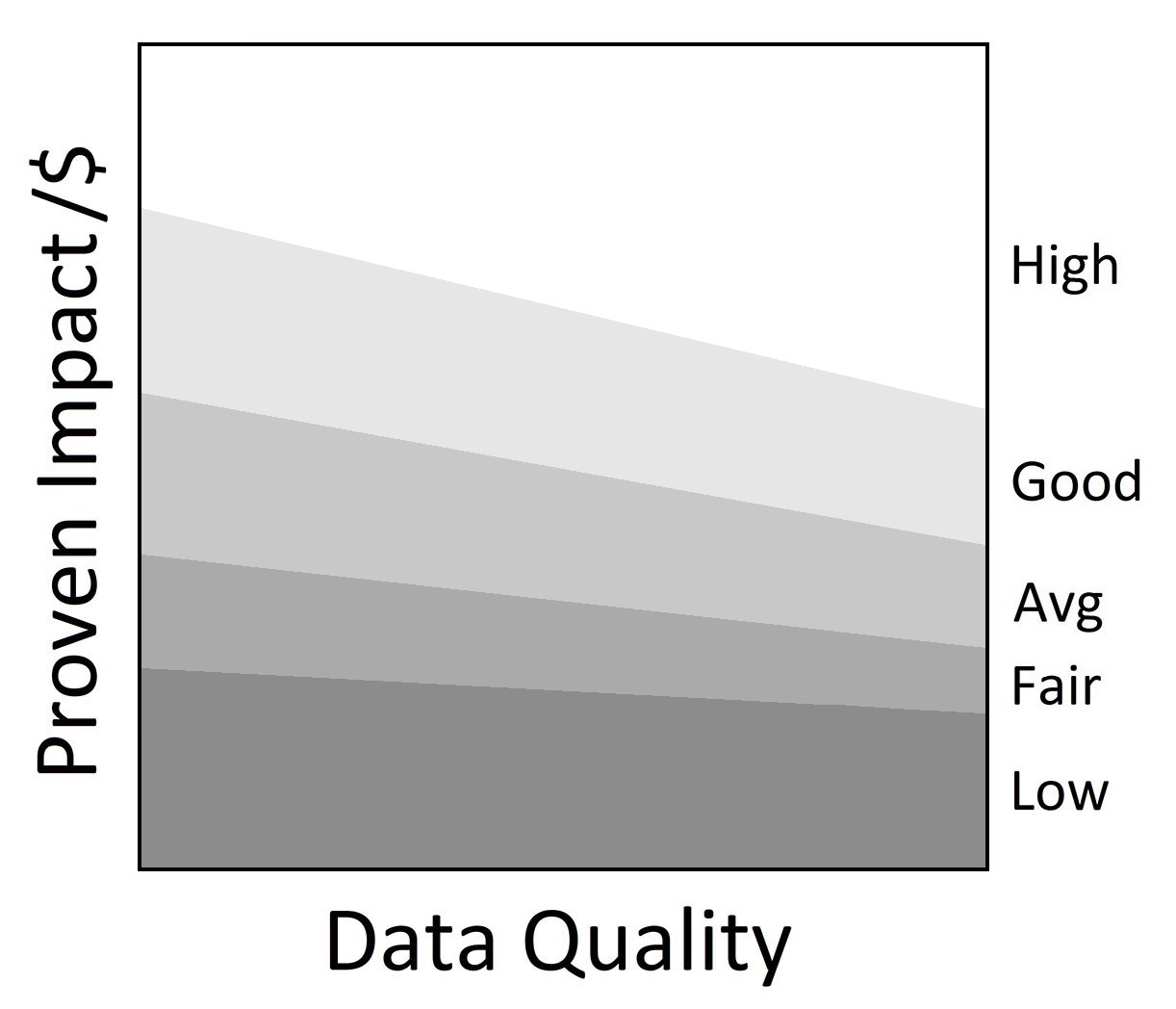

Charity Intelligence has given Easter Seals BC/Yukon a Low impact rating based on demonstrated impact per dollar spent.

Impact Rating: Low

My anchor

Finances

In F2021, Easter Seals BC/Yukon received $1.9m in Canadian donations and special events revenue. The charity received $1.2m in fees for service related to its camp program and Easter Seals House. It also received $480k of government funding (13% of total revenue).

Administrative costs are 14% of total revenue excluding investment income. Fundraising costs are 38% of Canadian donations. This results in total overhead spending of 52%. For every dollar donated to the charity, 48 cents go to the cause. This is outside Ci’s reasonable range for overhead spending. Easter Seals BC/Yukon has been outside of the reasonable range since F2013.

Easter Seals BC/Yukon has ($394k) in net funding reserves ($1.5m in liquid assets less $1.9m in interest-bearing debts). Its liquid assets also include $434k in donor-endowed funds. This results in a negative net program cost coverage ratio. The charity’s gross funding reserves, excluding donor endowed funds, can cover annual program costs for around six months.

This charity report is an update that has been sent to Easter Seals BC/Yukon and British Columbia Lions Society for review. Changes and edits may be forthcoming.

Updated on June 17, 2022 by Arjun Kapur.

Financial Review

Fiscal year ending September

|

2021 | 2020 | 2019 |

|---|---|---|---|

| Administrative costs as % of revenues | 14.2% | 11.9% | 12.2% |

| Fundraising costs as % of donations | 37.5% | 40.4% | 74.2% |

| Total overhead spending | 51.7% | 52.3% | 86.4% |

| Program cost coverage (%) | (42.2%) | (43.3%) | (78.8%) |

Summary Financial StatementsAll figures in $s |

2021 | 2020 | 2019 |

|---|---|---|---|

| Donations | 1,624,778 | 1,520,089 | 754,941 |

| Goods in kind | 5,420 | 54,667 | 301,579 |

| Government funding | 480,426 | 623,520 | 475,000 |

| Fees for service | 1,163,102 | 1,059,429 | 1,437,164 |

| Lotteries (net) | 0 | 0 | 3,926 |

| Special events | 263,703 | 244,244 | 634,519 |

| Investment income | 72,833 | 117,673 | 84,114 |

| Total revenues | 3,610,262 | 3,619,622 | 3,691,243 |

| Program costs | 1,987,008 | 1,567,373 | 1,804,815 |

| Donated goods exp | 5,420 | 54,667 | 301,579 |

| Administrative costs | 503,853 | 417,009 | 438,947 |

| Fundraising costs | 707,733 | 713,274 | 1,030,791 |

| Other costs | 50,524 | 97,915 | 96,466 |

| Total spending | 3,254,538 | 2,850,238 | 3,672,598 |

| Cash flow from operations | 355,724 | 769,384 | 18,645 |

| Capital spending | 516,459 | 271,077 | 207,672 |

| Funding reserves | (394,025) | (239,877) | (979,126) |

Note: To report on a cash basis, Ci adjusts for deferred contributions in donations, affecting total revenues by $57k in F2021, $645 in F2020, and ($253k) in F2019. Ci removes amortization of deferred capital contributions from revenue, and includes deferred capital contributions in donations, affecting total revenues by $53k in F2021, $223k in F2020, and ($98k) in F2019. Ci includes direct contributions to endowments within donations, affecting total revenue by $4.7m in F2021, $2.7m in F2020, and $2.3m in F2019.

Salary Information

$350k + |

0 |

$300k - $350k |

0 |

$250k - $300k |

0 |

$200k - $250k |

0 |

$160k - $200k |

0 |

$120k - $160k |

0 |

$80k - $120k |

3 |

$40k - $80k |

6 |

< $40k |

1 |

Information from most recent CRA Charities Directorate filings for F2021

My anchor

Comments & Contact

Comments added by the Charity:

Impact

There is no doubt that the last two years have brought unique challenges to us all, testing our strength and resilience as individuals and organizations. We are thrilled to say that Easter Seals has not only successfully survived, but has thrived, continuing to build capacity and deliver essential programs and services to be stronger than ever. By choosing to press on despite difficult circumstances, we became stronger, more creative and innovative.

Because of our need to pivot and change our program offerings due to public health orders, our staff, board and supporters surged ahead and created alternatives that enhanced and continued to serve the citizens of British Columbia and Yukon. The COVID-19 pandemic also brought even greater challenges for children, youth and adults living with physical and cognitive disabilities. Our creative approaches consistently addressed these issues at the forefront, always striving to improve conditions of isolation and socialization.

Easter Seals is grateful to have played a part in helping our community navigate their way through the uncertainty of the pandemic. Through community connection that is at the core of our programs and services, families found new friendships, children and adults with disabilities learned new skills, and our guests were warmly welcomed through the doors at Easter Seals House.

Key highlights from fiscal 2020-21 include:

Impact:

Impact:

Impact:

Impact:

Impact:

Impact:

FINANCIAL INFORMATION

Investment funds totalling $1.4 million are held to provide income to operations (2021- $72,833), as well as, to provide a financial reserve available to the organization to borrow in order to meet annual operating commitments. In 20/21, the Board authorized borrowing of up to $300K, but it was not accessed by Management.

Financial Ratios

Administration was 12.1% of total expenses

Fundraising costs were 35% of total revenue

With our small surplus, our Operating Ratio was 99%

Charity Contact

This email address is being protected from spambots. You need JavaScript enabled to view it. Tel: 604-873-1865