Shine Foundation

STAR RATINGCi's Star Rating is calculated based on the following independent metrics: |

✔

FINANCIAL TRANSPARENCY

Most recent Audited financial statements available on the charity’s website.

B-

RESULTS REPORTING

Grade based on the charity's public reporting of the work it does and the results it achieves.

Low

DEMONSTRATED IMPACT

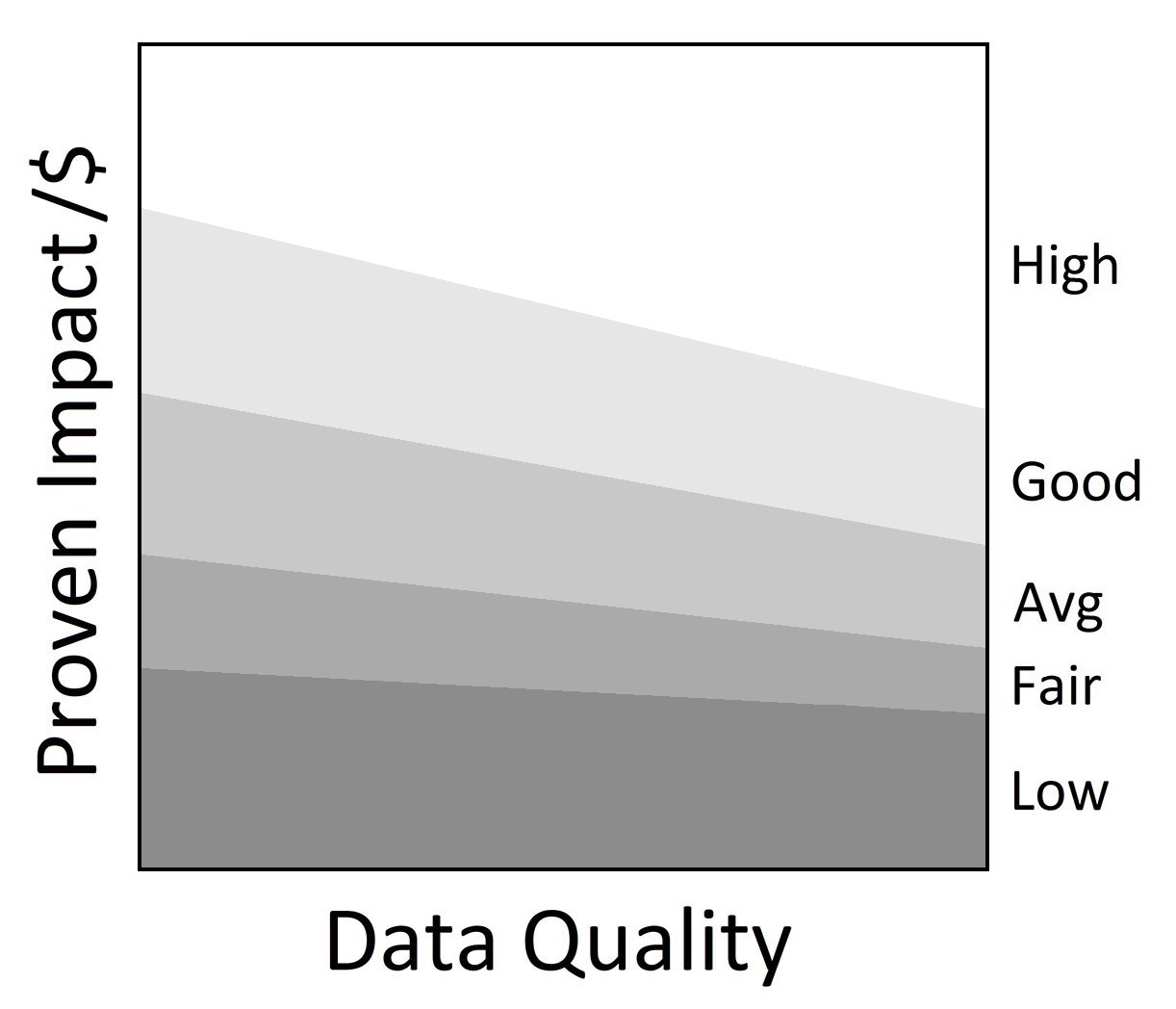

The demonstrated impact per dollar Ci calculates from available program information.

NEED FOR FUNDING

Charity's cash and investments (funding reserves) relative to how much it spends on programs in most recent year.

53%

CENTS TO THE CAUSE

For a dollar donated, after overhead costs of fundraising and admin/management (excluding surplus) 53 cents are available for programs.

My anchor

OVERVIEW

About Shine Foundation:

In 1987, Shine Foundation (Formerly Sunshine Foundation of Canada) was established by a London, Ontario father in memory of his son who passed away from muscular dystrophy. For over 30 years, Shine Foundation (Shine) has been working to make dreams come true for children living with severe physical disabilities and life-threatening illnesses. Shine grants wishes to kids ages 7-17 in order to help them build independence, confidence, and optimism. Since 1987, Shine reports that it has fulfilled dreams for over 8,000 children across Canada and coordinated 60 DreamLifts.

Shine Foundation of Canada spends 70% of its program costs on its Sunshine Dreams program. Through this program, the charity’s Dream Team delivers an individual experience dreamed by the child. The experience can include the child’s family, and Dreams can be anything from meeting a hero to going on an international trip. In F2018, Shine granted 50 wishes to children and their families.

Shine Foundation spends the remaining 30% of its program costs on its DreamLift program. In F2018, Shine ran its 63rd DreamLift and flew 79 children from London, St. Thomas, and Stratford regions to Walt Disney World for the day. The trip included 200 health workers that allowed each child to gain independence from their parents.

Using the F2018 total expenses, the average total cost of a Sunshine Dream experience per child was $12,493. The average total cost of a DreamLift trip per child was $3,389. Shine reports that 63,000 children currently qualify for a Sunshine dream experience.

My anchor

Results and Impact

Charity Intelligence has given Shine Foundation a Low impact rating based on demonstrated impact per dollar spent.

Impact Rating: Low

My anchor

Finances

Shine Foundation is a medium-sized charity, receiving $2.7m in donations and special events fundraising in F2018. Administrative costs are 13% of revenues, excluding investment income. Fundraising costs are 34% of donations and special event fundraising. For every dollar donated, 52 cents go to Shine's programs. This is outside of Ci’s reasonable range for overhead spending. Shine's funding reserves of $4m include $2.6m in donor-endowed funds. This results in a program cost coverage ratio of 174%, meaning the charity can cover program costs for 1.7 years using its existing funding reserves.

This charity report is an update that was sent to Shine Foundation for review. Changes and edits may be forthcoming.

Updated on June 3, 2019 by Caroline McKenna.

Financial Review

Fiscal year ending December

|

2018 | 2017 | 2016 |

|---|---|---|---|

| Administrative costs as % of revenues | 12.8% | 23.5% | 16.9% |

| Fundraising costs as % of donations | 34.1% | 45.6% | 43.7% |

| Total overhead spending | 46.8% | 69.1% | 60.7% |

| Program cost coverage (%) | 173.7% | 68.7% | 15.6% |

Summary Financial StatementsAll figures in $s |

2018 | 2017 | 2016 |

|---|---|---|---|

| Donations | 2,557,798 | 2,772,267 | 2,461,221 |

| Special events | 99,368 | 182,294 | 181,567 |

| Investment income | (42,091) | 235,868 | 203,847 |

| Total revenues | 2,615,075 | 3,190,429 | 2,846,635 |

| Program costs | 892,349 | 1,319,516 | 1,786,207 |

| Administrative costs | 339,273 | 693,620 | 447,645 |

| Fundraising costs | 905,122 | 1,346,637 | 1,155,820 |

| Total spending | 2,136,740 | 3,359,770 | 3,389,670 |

| Cash flow from operations | 478,331 | (169,344) | (543,037) |

| Capital spending | 3,084 | 8,421 | 38,630 |

| Funding reserves | 3,964,955 | 3,630,099 | 3,014,522 |

Note: Shine Foundation changed its fiscal year-end from August 31 to December 31 in 2017. Ci included financials from the 16-month period ending December 31, 2017 in F2017. The F2017 program cost coverage was adjusted to reflect a 12-month time period. Ci has adjusted amortization of deferred capital contributions affecting revenues by ($50k) in F2018, by ($129k) in F2017, and by ($160k) in F2016. Ci has adjusted amortization of capital assets affecting expenses by ($20k) in F2018, by ($44k) in F2017, and by ($33k) in F2016.

Salary Information

$350k + |

0 |

$300k - $350k |

0 |

$250k - $300k |

0 |

$200k - $250k |

0 |

$160k - $200k |

0 |

$120k - $160k |

2 |

$80k - $120k |

2 |

$40k - $80k |

6 |

< $40k |

0 |

Information from most recent CRA Charities Directorate filings for F2017

My anchor

Comments & Contact

Comments added by the Charity:

Charity Contact

This email address is being protected from spambots. You need JavaScript enabled to view it.