Dreams Take Flight

STAR RATINGCi's Star Rating is calculated based on the following independent metrics: |

✖

FINANCIAL TRANSPARENCY

Audited financial statements available only through official request for information from Charities Directorate.

D

RESULTS REPORTING

Grade based on the charity's public reporting of the work it does and the results it achieves.

Low

DEMONSTRATED IMPACT

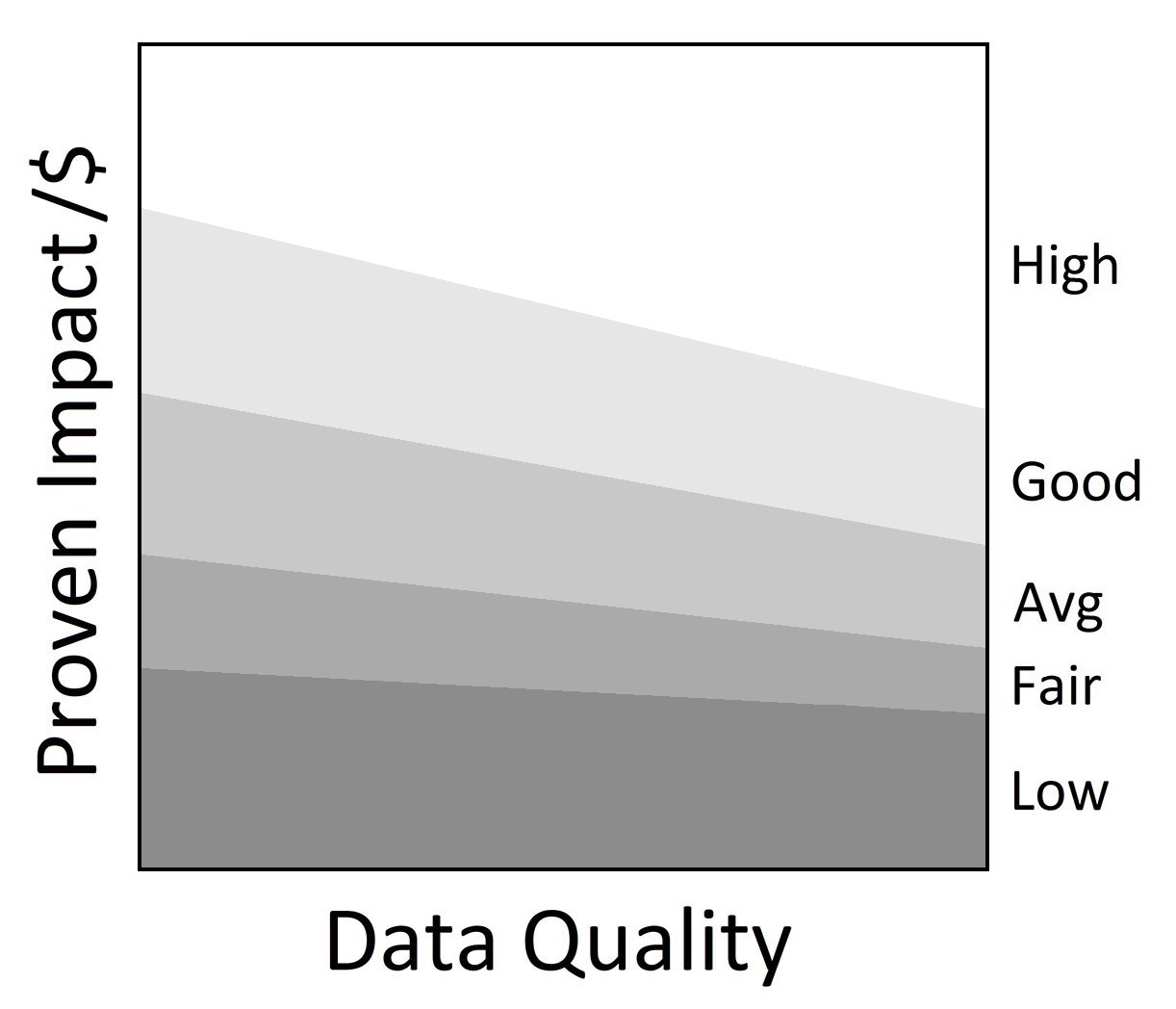

The demonstrated impact per dollar Ci calculates from available program information.

NEED FOR FUNDING

Charity's cash and investments (funding reserves) relative to how much it spends on programs in most recent year.

72%

CENTS TO THE CAUSE

For a dollar donated, after overhead costs of fundraising and admin/management (excluding surplus) 72 cents are available for programs.

My anchor

OVERVIEW

About Dreams Take Flight:

Dreams Take Flight is a 1-star charity with Low demonstrated impact. It has overhead spending within Ci’s reasonable range, but it is not financially transparent and has a low results reporting grade. Before you give, read Charity Intelligence’s report.

Founded in 1989, Dreams Take Flight (DTF) gives one-day all-expenses paid trips to Walt Disney World or Disneyland to children facing medical, mental, physical, social, or emotional challenges. Air Canada donates planes and volunteers raise money throughout the year. Donors give to cover all the expenses — aircraft fuel, park admission, spending money, plus cash for souvenirs and gifts.

Dreams Take Flight Canada sends planes from eight locations across Canada: Vancouver, Edmonton, Calgary, Winnipeg, Toronto, Ottawa, Montreal and Halifax. Each year, Dreams Take Flight Canada aims to take over 100 children on board from each chapter but the charity does not report on the number of children receiving a trip. The charity conducts one flight from each location annually, adding up to eight flights in all chapters.

My anchor

Results and Impact

416-801-5037

Impact Rating: Low

My anchor

Finances

Dreams Take Flight is not financially transparent and does not produce audited financial statements. This financial review is based on unaudited and redacted statements provided by the CRA.

In F2022, Dreams Take Flight Canada received total donations of $446k. Administrative costs are 28% of revenues (excluding investment income), and no fundraising costs are reported. This results in total overhead spending of 28%. For every dollar donated, 72 cents go to the cause. This is within Ci’s reasonable range for overhead spending.

The charity has $441k of reserve funds, which can cover three years and eight months of its annual program costs based on the most recent year but significantly less than a year based on pre-covid-19 program cost levels. Many flights were canceled during the pandemic lowering program costs.

This charity report is an update that has been sent to Dreams Take Flight Canada for review. Changes and edits may be forthcoming.

Updated on July 26, 2023 by Krystie Nguyen.

Financial Review

Fiscal year ending December

|

2022 | 2021 | 2020 |

|---|---|---|---|

| Administrative costs as % of revenues | 28.3% | 79.3% | 18.0% |

| Fundraising costs as % of donations | 0.0% | 0.0% | 0.0% |

| Total overhead spending | 28.3% | 79.2% | 18.0% |

| Program cost coverage (%) | 367.2% | 1,547.8% | 29.6% |

Summary Financial StatementsAll figures in $s |

2022 | 2021 | 2020 |

|---|---|---|---|

| Donations | 446,025 | 137,342 | 386,385 |

| Goods in kind | 0 | 0 | 1,075 |

| Fees for service | 1,051 | 3,876 | 5,151 |

| Business activities (net) | 0 | 0 | 28,863 |

| Special events | 0 | 652 | 455 |

| Other income | 682 | 16,889 | 0 |

| Total revenues | 447,758 | 158,759 | 421,929 |

| Program costs | 120,216 | 15,648 | 422,172 |

| Administrative costs | 126,791 | 125,810 | 76,016 |

| Fundraising costs | 0 | 0 | 0 |

| Other costs | 1,019 | 2,405 | 695 |

| Total spending | 248,026 | 144,182 | 498,883 |

| Cash flow from operations | 199,732 | 14,577 | (76,954) |

| Capital spending | 0 | 0 | 0 |

| Funding reserves | 441,399 | 242,205 | 124,903 |

Note: The charity reports having no paid employees in F2022.

Salary Information

$350k + |

0 |

$300k - $350k |

0 |

$250k - $300k |

0 |

$200k - $250k |

0 |

$160k - $200k |

0 |

$120k - $160k |

0 |

$80k - $120k |

0 |

$40k - $80k |

0 |

< $40k |

0 |

Information from most recent CRA Charities Directorate filings for F2022

My anchor

Comments & Contact

Comments added by the Charity:

Charity Contact

This email address is being protected from spambots. You need JavaScript enabled to view it. Tel: 416-801-5037