New Circles Community Services

STAR RATINGCi's Star Rating is calculated based on the following independent metrics: |

✔+

FINANCIAL TRANSPARENCY

Audited financial statements for current and previous years available on the charity’s website.

B

RESULTS REPORTING

Grade based on the charity's public reporting of the work it does and the results it achieves.

Low

DEMONSTRATED IMPACT

The demonstrated impact per dollar Ci calculates from available program information.

NEED FOR FUNDING

Charity's cash and investments (funding reserves) relative to how much it spends on programs in most recent year.

84%

CENTS TO THE CAUSE

For a dollar donated, after overhead costs of fundraising and admin/management (excluding surplus) 84 cents are available for programs.

My anchor

OVERVIEW

About New Circles Community Services:

New Circles Community Services is a 2-star rated charity with an average results reporting score and Low demonstrated impact. It is financially transparent and has overhead costs within Ci’s reasonable range.

Founded in 2005, New Circles Community Services (New Circles) aims to meet the basic needs of those living in poverty by providing clothing to Toronto residents. When clients visit New Circles to access free clothing, they are also directed to relevant social assistance programs offered by the charity or by other community groups.

New Circles provides three main programs: GLOW, employment training, and settlement support. The charity does not provide a breakdown of spending by program.

New Circles Community Services runs GLOW (Gently Loved Outfits to Wear), a free clothing bank service. In F2022, 200,862 items of clothing were provided through GLOW. In F2022, 14,422 clients were served by GLOW, of which 5,804 were children, 4,078 were women, and 4,540 were men.

New Circles runs employment training programs to equip clients with relevant skills. Business Office Skills is a 12-week program that trains participants to work in administrative or customer service positions. Program graduates receive a certificate from Centennial College. Retail and Customer Service Skills is also a 12-week training program, after which participants receive a certificate from the Retail Council of Canada.

The charity’s Newcomer Settlement Program supports newcomers to Canada in need of housing, childcare, employment, or social assistance. It provides case workers to meet with newcomers and make appropriate referrals to other agencies or New Circles employment programs. In F2022, the charity helped 1,156 people through this program.

My anchor

Results and Impact

New Circles reported that $1.7m worth of clothing was distributed through GLOW in F2022. GLOW clients can reportedly save up to $1,250 per year on clothing, allowing them to spend money on other necessities such as food.

The charity also reports a reduction in annual social assistance of $14,000 for every individual that completes its certificate-based programs and transitions to entry-level employment positions.

While Ci highlights these key results, they may not be a complete representation of New Circles’ results and impact.

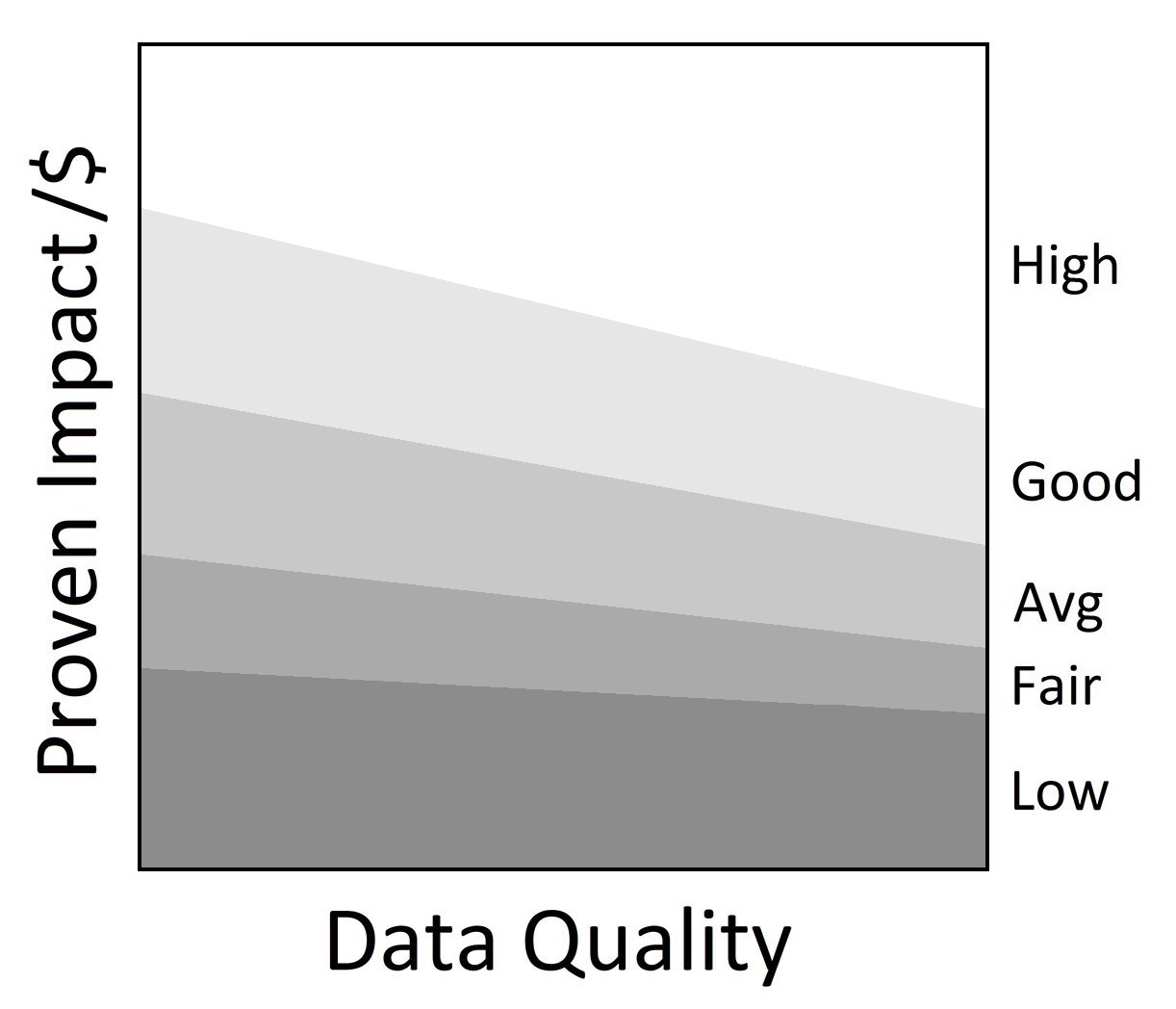

Charity Intelligence has given New Circles a Low impact rating based on demonstrated impact per dollar spent.

Impact Rating: Low

My anchor

Finances

New Circles Community Services received donations of $1.4m in F2022. The charity also received $518k in government funding in F2022, representing 21% of total revenues.

Administrative costs are 7% of revenues (less investment income) and fundraising costs are 10% of donations. This results in total overhead spending of 16%. For every dollar donated, 84 cents go to the cause. This is within Ci’s reasonable range for overhead spending.

New Circles has reserve funds of $2.4m which could cover one year and seven months of annual program costs.

This charity profile is an update that has been sent to New Circles Community Services for review. Changes and edits may be forthcoming.

Updated on July 21, 2023 by Kiara Andrade.

Financial Review

Fiscal year ending August

|

2022 | 2021 | 2020 |

|---|---|---|---|

| Administrative costs as % of revenues | 6.8% | 6.1% | 5.8% |

| Fundraising costs as % of donations | 9.6% | 8.5% | 6.6% |

| Total overhead spending | 16.4% | 14.7% | 12.4% |

| Program cost coverage (%) | 155.9% | 149.0% | 99.2% |

Summary Financial StatementsAll figures in $s |

2022 | 2021 | 2020 |

|---|---|---|---|

| Donations | 1,386,451 | 1,138,183 | 1,218,914 |

| Government funding | 517,961 | 570,061 | 372,369 |

| Investment income | 4,558 | 2,200 | 4,814 |

| Other income | 566,917 | 19,165 | 90,831 |

| Total revenues | 2,475,887 | 1,729,609 | 1,686,928 |

| Program costs | 1,540,358 | 1,081,155 | 982,690 |

| Administrative costs | 167,324 | 106,059 | 97,598 |

| Fundraising costs | 133,246 | 97,180 | 80,429 |

| Total spending | 1,840,928 | 1,284,394 | 1,160,717 |

| Cash flow from operations | 634,959 | 445,215 | 526,211 |

| Capital spending | 17,186 | 11,087 | 35,056 |

| Funding reserves | 2,400,679 | 1,611,346 | 975,297 |

Note: Ci reported government revenue from the charity’s T3010 filing with the CRA. The charity reported deferred contributions of $567k in F2022, $19k in F2021, and $91k in F2020. Ci could not break out government vs. non-government deferred contributions and therefore adjusted for them in Other income. Ci removed amortization of deferred capital contributions from revenues, affecting total revenues by ($6k) in F2022, ($6k) in F2021, and ($8k) in F2020. Ci reported administrative and fundraising costs from T3010 filings, and backed out the amounts not reported on the charity’s audited financials from program costs.

Salary Information

$350k + |

0 |

$300k - $350k |

0 |

$250k - $300k |

0 |

$200k - $250k |

0 |

$160k - $200k |

0 |

$120k - $160k |

0 |

$80k - $120k |

0 |

$40k - $80k |

9 |

< $40k |

0 |

Information from most recent CRA Charities Directorate filings for F2022

My anchor

Comments & Contact

Comments added by the Charity:

Charity Contact

This email address is being protected from spambots. You need JavaScript enabled to view it. Tel: 416-422-2591